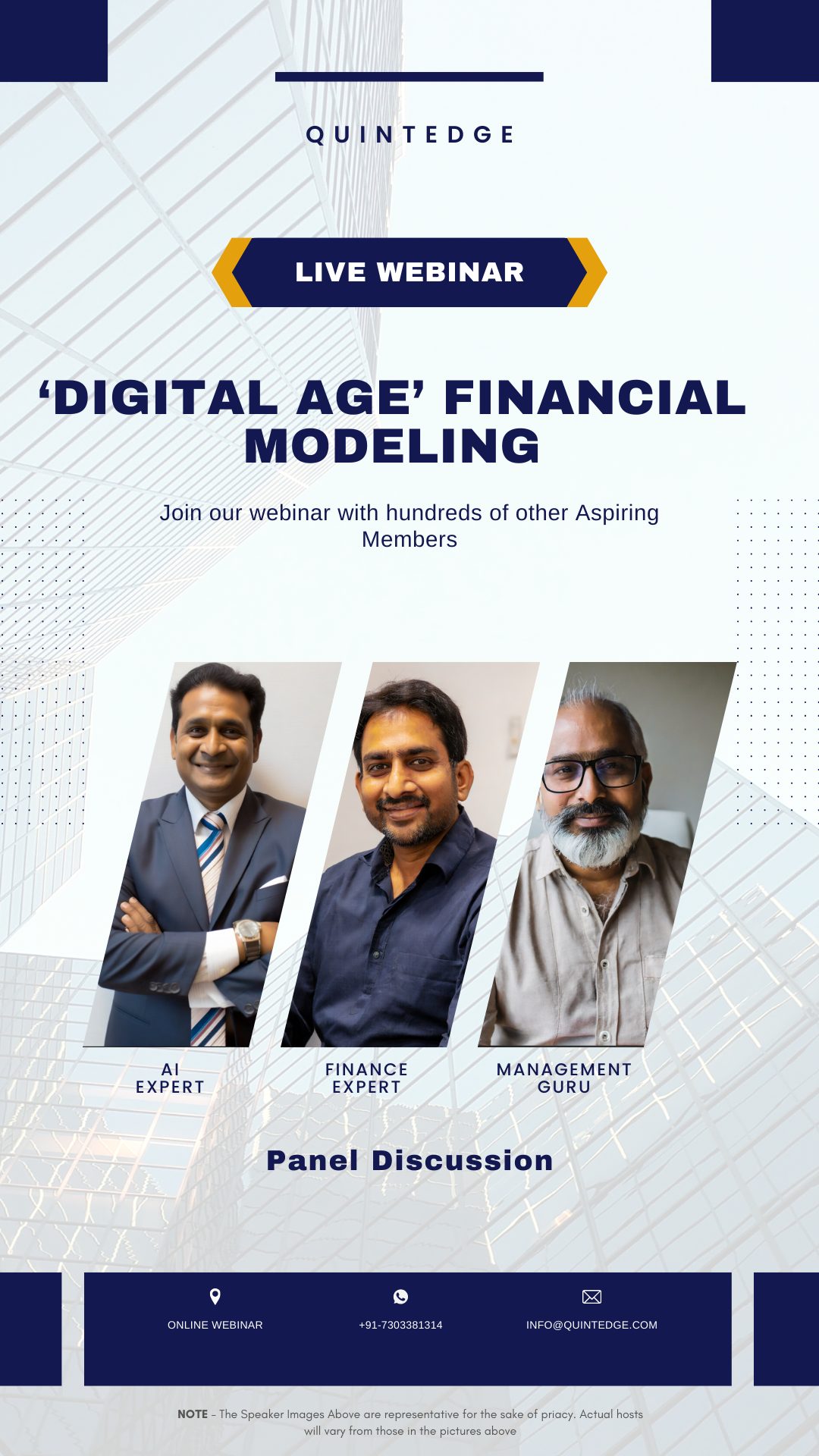

Upgrade Your Career

ACCA Advanced Taxation (ATX) Coaching Classes

- Advanced Taxation (ATX) coaching classes with 85% Success Rate

- 70 + Hours of HD Video Content with Detailed notes

- Live Doubt Sessions and Active Discussion Forum

- Sectional Practice Test and Full Length Mocks

- 100% Placement Assistance to Eligible Candidates

Get a Call - Back

What Makes Us The Best?

Below are a few key points that make us a preferred choice amongst students for Advanced Taxation (ATX) Coaching.

Highly Credible Trainers

Our trainers are ACCAs themselves and have Industry experience in Accounting, Taxation and Auditing.

Application Based Learning

We have designed training session in such a way that there is ZERO rote learning or mugging of formulae.

Exhaustive Preparation

We’ll cover practice questions in the Live class itself and Live revision classes a month before exam

High Pass Percentage

Out of the candidates who have taken ACCA Coaching through us, roughly 85% managed to clear the exam

Our Advanced Advanced Taxation (ATX) Curriculum

Our curriculum is thorough and highly oriented to the ACCA Examination.

How do we cover the syllabus efficiently?

- Income and income tax liabilities in situations involving further overseas aspects and in relation to trusts, and the application of additional exemptions and reliefs.

- Chargeable gains and capital gains tax liabilities in situations involving further overseas aspects and in relation to closely related persons and trusts together with the application of additional exemptions and reliefs.

- Inheritance tax in situations involving further aspects of the scope of the tax and the calculation of the liabilities arising, the principles of valuation and the reliefs available, transfers of property to and from trusts, overseas aspects and further aspects of administration.

- Corporation tax liabilities in situations involving overseas and further group aspects and in relation to special types of company, and the application of additional exemptions and reliefs.

- Stamp taxes

- Value added tax, tax administration and the UK tax system

- Taxes applicable to a given situation or course of action and their impact.

- Alternative ways of achieving personal or business outcomes may lead to different tax consequences.

- Taxation effects of the financial

decisions made by businesses

(corporate and unincorporated) and by

individuals. - Tax advantages and/or disadvantages of

alternative courses of action. - Statutory obligations imposed in a given

situation, including any time limits for

action and the implications of non–

compliance.

- Types of investment and other

expenditure that will result in a reduction in tax liabilities for an individual and/or a business. - Legitimate tax planning measures, by which the tax liabilities arising from a particular situation or course of action can be mitigated.

- The appropriateness of such investment, expenditure or measures, given a particular taxpayer’s circumstances or stated objectives.

- The mitigation of tax in the manner recommended, by reference to numerical analysis and/or reasoned argument.

- Ethical and professional issues arising from the giving of tax planning advice.

- Communication

- Analysis and evaluation

- Scepticism

- Commercial acumen

- Use computer technology to efficiently access and manipulate relevant information.

- Work on relevant response options, using available functions and technology, as would be required in the workplace.

- Navigate windows and computer screens to create and amend responses to exam requirements, using the appropriate tools.

- Present data and information effectively, using the appropriate tools.

Hands-On Experience with Leading Accounting Tools

Our ACCA Coaching integrates leading accounting tools, for hands-on experience & competitive edge in the job market

Advanced training in Excel for financial analysis and reporting

Power BI & Tableau

For Visualization and Analysis of Complex Financial Data

QuickBooks

To reach efficient bookkeeping and financial management.

Xero

Cloud-based accounting software for real-time financial tracking

Exclusive Content Access

Unlock Premium Resources: Your Comprehensive ACCA Toolkit

Custom-Developed Textbooks

Toughest ACCA concepts with easy explanations that go beyond standard textbooks, designed to enhance critical thinking and application skills

Proprietary Mocks & Question Bank

Unique sets of practice questions and mock exams that closely mimic the style and difficulty of the actual ACCA exams.

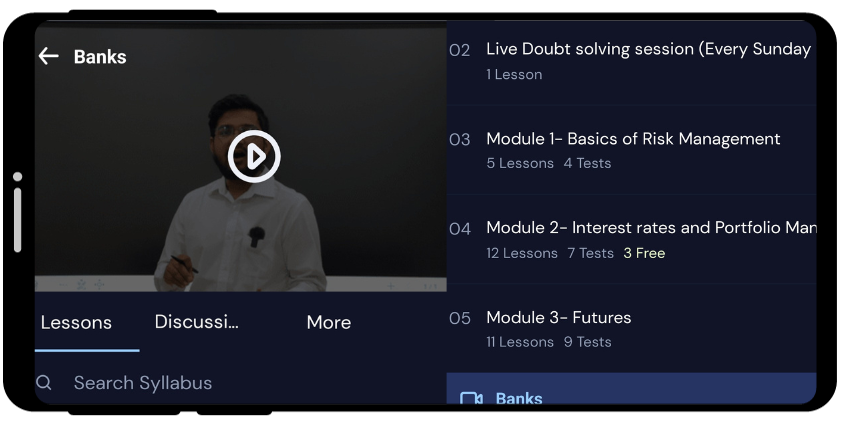

Mobile App With Up-to-Date Resources

Our mobile app provides instant access to all our study materials, updated regularly to reflect the latest ACCA syllabus.

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge

Where we go the extra mile in ACCA prep unlike any other

Offering

Others

24/7 Peer and Tutor Forums for immediate query resolution

Exclusive industry insights with current market trends

Continuous course updates, ensuring current content relevancy

Pass Assurance for ACCA Prep Course Students

Full Length Mock ACCA Tests with ‘Near’ Exam Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier Accounting professionals

Dedicated ACCA Exam Faculty for last-minute doubt solving

Dedicated post-exam debrief sessions and improvement strategies

Discover The Seamless Learning Experience

Our Platform's Features

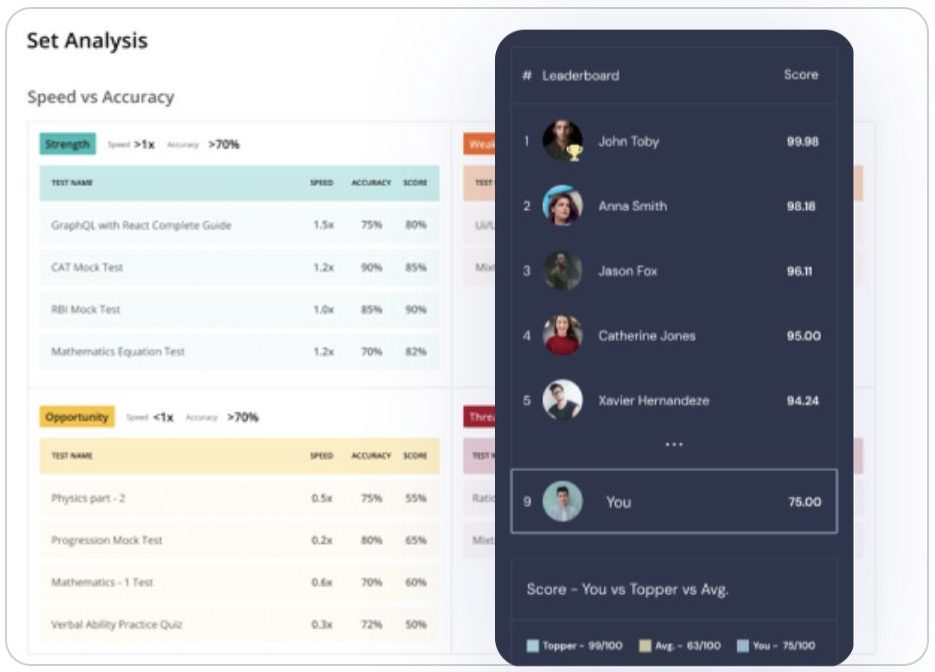

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

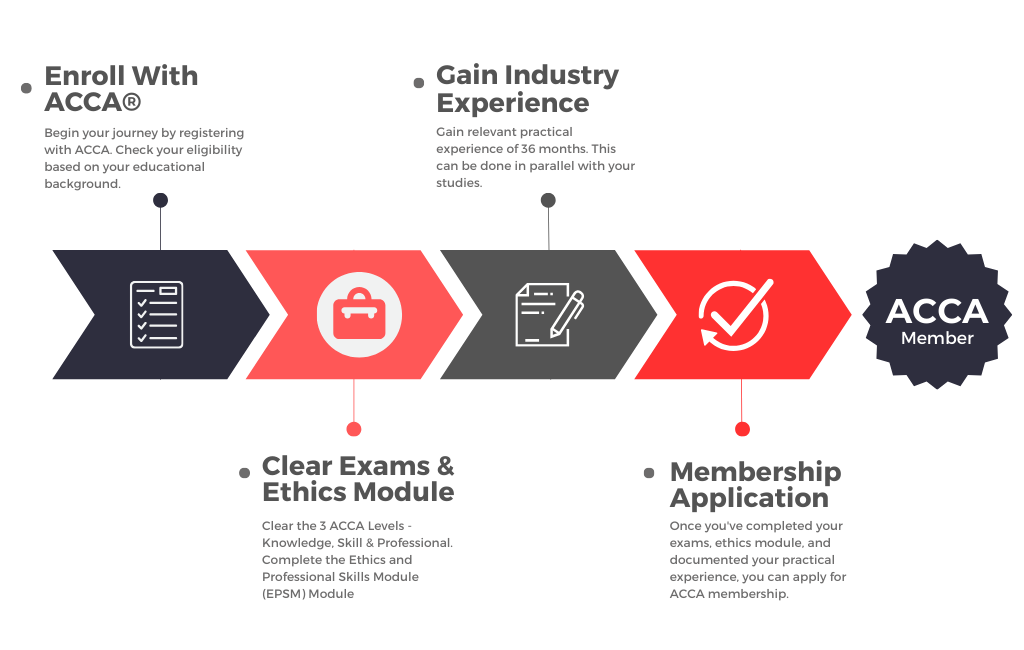

Know Your Timeline

How to become an ACCA Qualified?

Charting Your Path to ACCA Success: A Step-by-Step Journey with Quintedge

Our Faculty Members

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash Jain

Mr. Yash Jain, Ex Senior Associate at Bain & Company, is an esteemed ACCA, CFA, and FRM trainer. With experience training 5000+ students, he’s also led sessions at IIT Delhi and Goldman Sachs, offering unmatched expertise in Corporate Finance and Strategy.

Krupang Purohit

Mr. Krupang is a maestro of financial dynamics. Specializing in Management and Financial Accounting, he combines strategic leadership with creative teaching skills. His work spans from conducting tax audits to fund management, showcasing his versatility & passion in the field.

Nitin Choudhary

Mr. Nitin is a dual-qualified expert as both a CA and ACCA member, renowned for his practical approach and deep understanding of global accounting standards. His ability to bridge theory with real-world application makes him a favorite among students.

Madhurika R.

Ms. Madhurika is a renowned visiting trainer at ICAI & ICSI, and across various schools and colleges. Specializing in Risk Management, Business Studies, and Financial Management, she has extensive experience in the banking sector and internal audits across diverse industries. .

Placements & Career Assistance

Placement Assistance Program

Crack Jobs At Best Management Accounting Roles

Learn with real work experience and get placed at Top Finance & Accounting based Job Roles.

- Experiential Masterclasses by Investment Bankers

- AI Based Resume Maker Tool Trained by Industry Experts

- Interview Preparation AI tool based on 10,000 Questions asked in Real Interviews

- Job Opportunities in Core Finance Roles

Career Counseling

Personalized career guidance in identifying work goals and potential job roles

End-To-End

Extensive Support , starting from Job search, to getting the offer letter from Company

Access Duration

3 Months

Job Applications

Unlimited

Mock Interviews

Unlimited

AI Based Resume Drafting

3 Drafts

Monthly Masterclasses By Industry Experts

Making You Well Versed With Current Industry trends

What We've Achieved?

Our Awesome Past Records

Over the years, our students’ satisfaction and the success rate are worth an eyeball.

Batches Taken

Countries

Pass Rate

ACCA Students

Work At Big 4s, Unicorns, Or MNCs

Build your Skillset with us and impress recruiters at unicorns, global MNCs, and Big 4s.

ACCA Testimonials

From the Past Candidates

Read on to know what our students have to say

Parv Mehra

Their ACCA classes were so much more than just lectures. Imagine diving into the trickiest accounting concepts with pros who've been there and done that. We tackled real-life cases, which was way more useful than just reading a textbook. I walked away from each session not just understanding the stuff better, but feeling like I could actually handle whatever the exams threw at me.

Kartik Jain

Joining the ACCA prep course was a major step for me, and what really made it worth it was the Career Guidance and Support. It's not just about passing exams here; they genuinely prepare you for what's next. The career workshops, resume tips, and mock interviews were beyond helpful. I felt like I was getting an inside scoop on the accounting world.

Udit Malhotra

I was particularly impressed by their Comprehensive Study Material. The depth and breadth of resources were astounding — from detailed notes to quizzes and revision kits. Every resource was up-to-date and aligned perfectly with the ACCA syllabus. The conceptual clarity of the materials made complex topics easier to understand and remember.

Nimisha Garg

The highly accessible & friendly teachers at Quintedge's ACCA Prep Course made things easier for me. Studying for such a demanding exam can be daunting, but knowing that help was just a message away, was incredibly reassuring. Whether I had a quick question or needed a detailed explanation, the instructors were always there, ready to assist.

ACCA Scope, Salary and Opportunities

Let’s get to know how this qualification can shape your future and career.

Recognition

ACCA is recognised as the most comprehensive course in Accounting and thus well respected in Accounting fraternity worldwide.

Job Profiles

ACCA Qualified Candidates get opportunity to work in top notch Accounting profile like Audit, Taxation, Management Accounting, Financial Analysis etc.

Median Salary

Initial median salary of ACCA Degree holder in Indian is between Rs. 9.00 Lakhs to Rs. 12.00 Lakhs per annum, which increases exponentially with career progress

Choose A Preparation Plan That's Right For you

Advanced Taxation (ATX)

Live - ₹ 26,000

- Live Instructor Led Classes

- HD Videos with Unlimited Replays

- Concept Wise Quizzes

- Near Exam Level Mock Tests

- Discussion Forum and Doubt Solving

Advanced Taxation (ATX)

Recorded - ₹ 16,000

- Live Instructor Led Classes

- HD Videos with Unlimited Replays

- Concept Wise Quizzes

- Near Exam Level Mock Tests

- Discussion Forum and Doubt Solving

Have Doubts?

Know More About ACCA Exam

Unlock insights into the ACCA® designation – the gold standard in Accounting

Charter Your Career With Our ACCA Advanced Taxation (ATX) Coaching in Delhi

The Association of Chartered Certified Accountants (ACCA) is a UK-based certification that is recognised globally. It prepares an individual to flourish in the ever-changing world of finance. Businesses value ACCA members for their great technical knowledge, analytical abilities, and moral basis.

ACCA’s acclaimed reputation extends to 180 countries, providing a key to international job opportunities for ACCA qualified. QuintEdge’s online coaching for ACCA Advanced Taxation (ATX) develops adaptable professionals with a varied skill set, ready to face the evolving demands of the accounting industry.

Why You Should Pursue ACCA?

The Association of Chartered Certified Accountants (ACCA) serves as a lighthouse for ambitious finance professionals, providing access to a world of opportunity and professional development. Key benefits of pursuing ACCA:

- ACCA’s worldwide recognition exposes individuals to a plethora of global opportunities. This allows individuals to pursue rewarding jobs in a variety of fields and geographical regions. With ACCA global presence in over 180 countries, it provides unrivalled flexibility and access to a network of top businesses and institutions globally.

- ACCA is one such course that has an extensive curriculum which caters to a variety of aspects of the financial field such as accounting, taxation, auditing, and much more. By pursuing this course, individuals increase the depth of financial knowledge allowing them to undertake strong analytical tasks rather than just standard accounting work. Find out more about the ACCA – ACCA Course Details & Subjects

- Companies are always looking for candidates that are not only knowledgeable but possess strong analytical skills, and adherence to ethical norms. ACCA demonstrates an individual’s commitment to their field, which showcases candidates’ dedication towards learning. Furthermore, ACCA offers a clear path for career promotion, with prospects to ascend to senior positions within organisations.

- Majority of candidates pursuing ACCA are students or working professionals who can dedicate a limited amount of time towards their studies. Keeping this in mind, QuintEdge’s ACCA classes in Delhi allow its learners to customise their learning experience. This flexibility allows people to manage their academics and work obligations while also pursuing ACCA certification.

- ACCA’s empowers individuals to keep on educating themselves. This way they have the advantage to learn about new industry advances and new trends. Through Continuing Professional Development (CPD) requirements, ACCA-qualified individuals are privileged to a plethora of resources and chances for skill building, allowing them to remain relevant in a quickly changing business context.

Eligibility of ACCA Course in Delhi

To be eligible for ACCA coaching in Delhi, you must have scored at least 65% in English, Math, or Accounts, and 50% in other subjects. Additionally, recent graduates and students enrolled in professional programmes like CA, CS, or CMA can also consider pursuing this qualification.

An individual can be eligible for exemptions from certain papers based on their existing qualifications. The ACCA offers 13 papers in total, which are further divided into three levels. A candidate must pass each level to become a certified ACCA. Once become ACCA qualified you can have a higher probability of gaining placement in Big 4 firms, Multinational Companies (MNCs), and national businesses.

Why Choose QuintEdge for the Best ACCA Advanced Taxation (ATX) Classes in Delhi?

QunitEdge is a leading platform for learning finance and provides tailored and extensive online coaching for various financial courses like CFA classes, FRM online classes, ACCA coaching, and online courses in Investment Banking.

QuintEdge recognises the critical role of ACCA in developing the future of professionals across the world. Our ACCA in Delhi coaching aims to help aspirants navigate the complexity of this prestigious certificate.

QuintEdge is an ideal ACCA Advanced Taxation (ATX) classes platform that overcomes the constrain of geographical boundaries, allowing students to plan their ACCA journey at their preferred speed. QuintEdge also provides you with a placement assistance programme that moulds you into a perfect candidate for your desired job. Within the 3 months of access, you can explore unlimited mock interviews, monthly industry masterclasses, 3 AI-based resume drafting and unlimited job applications.

QuintEdge is dedicated to assisting you in each phase of the way to success in your career through our comprehensive curriculum, skilled professors, and personalised support. Enrol today and begin your journey to a brighter career in finance.

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

To register for our Live Coaching, you can call up our counsellors and they will guide you with the registration process.

There will be roughly 100 hours of training for every subject, amounting to roughly 70+ hours for complete course.

To be Enroll for Advanced Taxation (ATX) coaching, you need have a clear mindset of pursuing ACCA. There’s no eligibility as such.

After you become a ACCA, you can get into core Accounting & Finance profiles such as Taxation, Management Accounting, Auditing etc.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.