Upgrade Your Career

CFA Coaching Classes

- CFA coaching classes with 88% Success Rate

- 200 + Hours of HD Video Content with Detail notes

- Live Doubt Sessions and Active Discussion Forum

- Sectional Practice Test and Full Length Mocks

- Video solutions of CFA Institute's Official Material questions

- Quintedge's AI Based Real-Time CFA Doubts Solver

Get a Call - Back

What Makes Us The Best CFA Coaching?

Below are a few key points that make us a preferred choice amongst students for CFA Coaching.

Highly Credible Trainers

Our trainers are CFAs themselves and have experience in Investment banking, Equity research and corporate finance

Application Based Learning

We have designed training session in such a way that there is ZERO rote learning or mugging of formulae.

Exhaustive Preparation

We’ll deliver 100% practice questions in the Live class itself and Live revision classes a month before exam

High Pass Percentage

Out of the candidates who have taken CFA Coaching through us, roughly 88% managed to clear the exam

CFA Coaching Curriculum

Our curriculum is thorough and highly oriented to the CFA Examination.

How do we cover the syllabus efficiently?

- Time value of money.

- Basics of probability.

- Measures of central tendency and dispersion, downside deviation and coefficient of variation, correlation and share of distribution.

- Introduction to linear regression, Multiple regression and time series analysis.

- Basics of Machine learning and big data projects.

- Demand and supply concepts and different types of different market structures

- Aggregate outputs, prices and economic growth

- Credit cycles and their relationships to Business cycles, inflation, unemployment.

- Roles of central banks in economy, Monetary and fiscal policies and their interrelationships

- Economic growth and why it matters to investors, factors that affect economic growth

- Economic regulations and cost benefit analysis of regulations

- Forex forward markets and framework for exchange rates, Impact of monetary policies and fiscal policies on exchange rates.

- Developing understanding of Income Statement, Balance Sheet and Cash Flow statement

- Developing understanding of various components of Financial statements like Inventory, Income Tax, Long lived assets, Non-Current liabilities.

- General accepted accounting principles vs International Financial reporting standards (GAAP vs IFRS) differences in ways of accounting.

- Accounting for Intercorporate investments (Investments in financial assets/Associates/Business combination)

- Accounting for multinational operations (Translation and measurements)

- Accounting for Employee compensation (Defined benefit plans and share based compensation)

- Analysis of financial statements of banks and insurance companies

- We learn about various ways to calculate cost of capital, working capital management and corporate governance and ESG issues.

- Nitty -gritty of Merger & acquisitions, reasons behind M&A activities, merger defence techniques and merger valuation.

- Capital structure theories and factors affecting capital structure.

- Factors affecting Dividend decisions, Dividend decisions vs Share buybacks.

- Importance of ESG in investing decisions.

- Industry and company analysis

- Equity valuation using various methods using Intrinsic valuation (Discounted cash flows/ dividend discounted model), Relative valuation (Trading comparable and transaction comparable) and residual income valuation.

- Private company valuation

- Valuation of Fixed income security

- Developing understanding of risks involved in fixed income and returns earned

- Evolution of interest rates (Spot rate, forward rates, shape of yield curve.

- Arbitrage free value of fixed rate coupon bond and bond with embedded options.

- Credit analysis using statical models.

- Credit default swaps.

- Forward/Futures and options, their uses and pricing

- Caps, Floors and swaptions uses and pricing

- Options strategies and their pays

- Binomial model, Interest rate option, Black-Scholes-Merton model, Black model

- Option Greeks and Implied volatility.

- Analysis of real estate valuation

- Analysis of private equity valuation

- Introduction to commodities and commodity derivatives

- Hedge funds investments, structures and fees calculations

- Portfolio risk and returns calculation

- Portfolio planning and construction and behavioural biases in portfolio contrition

- EFT structure and uses in portfolio management

- Multifactor models and their uses to create factor portfolio

- Measurement of portfolio risks

- Backtesting and simulating portfolio

- How state of economy impacts Investment markets and consumption habits of individuals

- Analysis of actively managed portfolio, risk/return attribution of actively managed portfolio

- Why ethics is important in investment profession

- Code of Ethics and standards of professional conduct and their application

- Introduction to global Investment performance standards

A focused module that blends CFA exam preparation with hands-on training in financial modeling and Excel. It’s designed to help students connect core finance concepts with practical application.

Key highlights include:

- Excel training from basic functions to advanced tools

- Application-based learning through real-world case studies

- Strong foundation in financial modeling and analysis techniques

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge

Where we go the extra mile in CFA prep unlike any other

Offering

Others

24/7 Peer and Tutor Forums for immediate query resolution

Exclusive industry insights with current market trends

Continuous course updates, ensuring current content relevancy

Pass Assurance for CFA Prep Course Students

Full Length Mock CFA Tests with ‘Near’ Exam Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier finance professionals

Scholarship & Registration Guidance fro CFA Students

Dedicated CFA Exam Faculty for last-minute doubt solving

Dedicated post-exam debrief sessions and improvement strategies

Advanced Doubt Solving Assistance

Our advanced AI doubt solver provides round-the-clock support, enabling you to get accurate answers whenever you need them. Designed specifically for CFA candidates, it ensures uninterrupted, efficient learning.

-

Available 24/7, get answers in seconds

-

Trained specifically for the CFA curriculum

-

Included with Our Course

Discover The Seamless Learning Experience

Features of Our CFA Coaching Platform

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

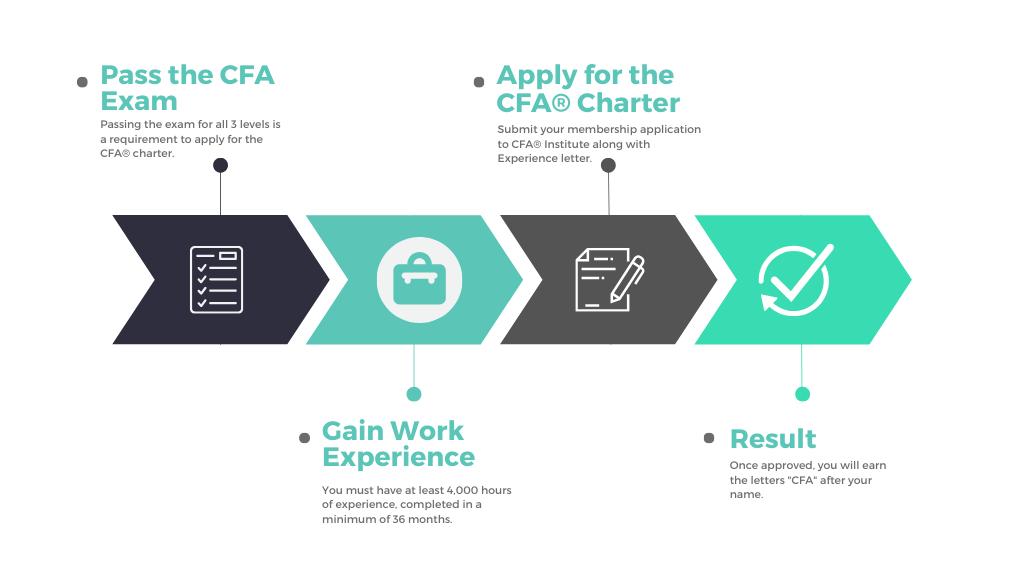

Know Your Timeline

How to become a CFA Charterholder?

Charting Your Path to CFA Success: A Step-by-Step Journey with Quintedge

Faculty for Our CFA Coaching

Industry Leading Trainers

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash Jain

Yash is a seasoned Investment Banking Trainer and Ex – Senior Associate at Bain & Co. specializing in Corporate Finance. He has trained over 5000 candidates till date and is renowned for his engaging sessions at prestigious institutions like IIT, Goldman Sachs, and NIFM.

Shubham Goyat

Mr. Shubham is a CFA Charterholder with a rich background in Finance Industry. His extensive experience in financial analysis provides a solid foundation. He blends theoretical knowledge with real-world applications to equip students with a comprehensive understanding of the financial industry.

Rohit Sachdev

Rohit Sachdev is an adept Options Trader with extensive experience, specializing in both Fundamental and Technical Analysis. His background as an Investment Banker at Deutsche Bank and FRM Charterholder underscore his deep understanding of financial markets.

Sahil garg

Sahil Garg is an experienced CFA trainer with real-world experience in investment banking and global finance. Having worked at Genpact in IB roles and with firms like EDF Renewables, he brings practical market insights into the classroom—making CFA concepts engaging, relevant, and industry-aligned.

What We've Achieved?

Our Awesome Past Records

Over the years, our students’ satisfaction and the success rate are worth an eyeball.

0 +

Batches Taken

0

Countries

0 %

Pass Rate

0 +

CFA Students

CFA Coaching Testimonials

From the Past Candidates

Read on to know what our students have to say

CFA Scope, Salary and Opportunities

Let’s get to know how this qualification can shape your future and career.

Recognition

CFA is recognised as the most comprehensive course in Finance and thus well respected in Finance fraternity worldwide.

Job Profiles

A CFA Charterholder gets opportunity to work in top notch finance profile like portfolio management, Financial Modeling, Investment Banking etc.

Median Salary

Initial median salary of CFA charter holder in Indian is between Rs. 9.00 Lakhs to Rs. 12.00 Lakhs per annum, which increases exponentially with career progress

Fees & Variants of CFA Coaching

CFA Level I

Live Online Classes

₹ 32,000

- Live CFA Level - I Classes with Unlimited Doubt Solving, Interactive webinars, and 100% Question Coverage

CFA Level I

Offline / Hybrid Classes

₹ 35,000

- Live CFA Level - I Classes with Unlimited Doubt Solving, Interactive classes, and 100% Question Coverage

CFA Level II

Live Online Classes

₹ 33,000

- Live CFA Level - II online Classes with Unlimited Doubt Solving, Interactive webinars, and 100% Question Coverage

CFA Level I

₹ 27,000 Onwards

- Self Paced CFA Level - I Classes with Unlimited Doubt Solving, Interactive Videos, and 100% Question Coverage

CFA Level II

₹ 29,000 Onwards

- Self Paced CFA Level - II Classes with Unlimited Doubt Solving, Interactive Videos, and 100% Question Coverage

Integrated Financial Analyst Program

ADMISSION OPEN

- Especially For Commerce Students, CA Students & Qualified CAs.

- Live Instructor Led Classes

- Access to Learning Portal with HD Video Content

- Training on Latest Finance Tools

- Placement Assistance

- Lectures With FM&V Industry Experts

- Financial Modeling and Valuation Classes

AI Scholarship Evaluator

Are You Applying For CFA Institute's Scholarship?

Try out our Free AI Based CFA Scholarship Essay Evaluator to exponentially increase your chances of getting the CFA Institute’s Fees Waiver.

Have Doubts?

Know More About CFA Exam

Unlock insights into the Chartered Financial Analyst® designation – the gold standard in finance

Ace the CFA Exams with QuintEdge's CFA Coaching

In the dynamic field of finance, CFA stands for Chartered Financial Analyst and is a symbol of expertise and excellence. Whether you are opting for investment management, financial analysis, or portfolio management, choosing a career in CFA opens doors to many opportunities.

But first thing first let’s take you through the importance of CFA, eligibility criteria, the requirement of CFA coaching, and how QuintEdge ends up being the top priority of CFA aspirants.

Understanding Chartered Financial Analyst (CFA) Course

So what exactly is CFA? and how difficult is CFA exam? The most sought-after designation for financial professionals across the globe. If your area of interest lies in investment management and financial analysis, you need to major in CFA. The CFA is one of the most respected and reputable financial designations. But to master CFA, you need to have the right knowledge and skills, for which you can rely on the best CFA coaching institute in India – QuintEdge. We understand that the competition is fierce and we can help you top the CFA course with ease. Divided into two levels, CFA curriculum is an arrangement of essential topics:

- CFA Level 1 Coaching: The first step on the CFA journey is passing the level 1 exam. The first level aims at laying a solid financial base in investment tools, asset valuation, financial reporting, and ethics. CFA level 1 coaching grants a candidate the required support and resources needed to master the wide scope of subjects in this test. Level 1 training improves the knowledge of the applicants on quantitative techniques and corporate finance, the platform that is needed to achieve success.

- CFA Level 2 Coaching: The foundation of CFA level 2 coaching is in level 1 coaching. CFA level 2 coaching is a thorough examination of asset valuation, financial statements analysis, and portfolio management. This requires more knowledge of complicated financial concepts and practicality. CFA coaching at level 2 is a roadmap for an aspirant to refine their analytical skills in the real field through practice. With suitable teaching and thorough revision aids, level 2 training makes a candidate ready for a watershed in the CFA journey.

Eligibility Criteria For CFA Course

To have a career in CFA an aspirant must have a bachelor’s degree in finance and relevant work experience. The CFA coaching institutes in India outline specific requirements, making sure that an aspirant must have the foundation knowledge and experience necessary to succeed in the program.

While the CFA curriculum is rigorous, enrolling in CFA coaching classes can enhance your preparation and success. Through detailed instruction, practice exams, and expert guidance, CFA coaching institutes like QuintEdge provide vital support to all aspirants. If you are tackling complicated financial concepts or redefining your exam strategy, coaching institutes can help you with the right preparation and approach to succeed in your CFA exams.

Why Choose QuintEdge for CFA Coaching Classes?

QuintEdge takes pride in offering the best CFA coaching program that is designed as per the guidelines and syllabus. Our experienced instructors, comprehensive study materials, and holistic approach toward teaching ensure that each aspirant receives the support they need to excel in CFA. With a proven track record of success, QuintEdge has emerged as one of the best CFA coaching institutes in India. Our alumni attest to the transformative impact of our coaching programs, not only in CFA but also in investment banking programs, FRM coaching, and ACCA coaching.

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

The Chartered Financial Analyst (CFA) course, offered by the CFA Institute, is a globally respected certification for investment and financial professionals. It helps individuals gain valuable skills in investment management and financial analysis, boosting their careers.

The CFA course is ideal for finance professionals aiming to enhance their investment management skills and knowledge. It’s particularly beneficial for portfolio managers, investment advisors, financial analysts, and anyone interested in a career in the finance sector.

To register for our Live Coaching, you can call up our counsellors and they will guide you with the registration process.

There will be 40 classes of 3 hours each in the Live course, amounting to roughly 120 hours of training.

To be eligible for CFA coaching, you need to be in the final year of graduation. You should also have a valid international passport.

After you become a CFA Charterholder, you can get into core finance profiles such as Valuations, Investment Banking, Portfolio Management etc.

The CFA exams are structured as follows: Levels I and II feature multiple-choice questions with item sets, while Level III includes both essay-type questions and item sets. Each exam is divided into two sessions: a morning session and an afternoon session.

Yes, you can retake the CFA exams if you don’t pass on your first attempt. The CFA Institute has specific policies regarding the waiting period and registration process for retakes.

Our instructors are CFA charterholders with extensive industry experience. They are chosen for their deep knowledge and proven teaching abilities, ensuring you receive the best possible preparation for your CFA exams.

Students in our CFA Coaching receive comprehensive study materials created by our expert faculty. These include textbooks, practice questions, summary sheets, and mock exams, all regularly updated to reflect the current CFA curriculum.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.