Upskill Yourself

Financial Modeling Course in Delhi

- Financial Modeling Course in Delhi with 100% Placement Support

- 180 + Hours of HD Video Content with Detail notes

- Lectures by seasoned investment bankers and industry experts.

- Hands-on Financial Modeling simulations for practical application.

- Real-world case studies and examples from notable deals.

Get a Call - Back

What Makes Us The Best?

Below are a few key points that make us a preferred choice amongst students for Financial Modeling Course in Delhi

Fully Practical Approach

Learn Financial Modeling and valuation from the real-world perspective, not books

Highly Credible Trainers

Our trainers are Investment Bankers themselves and have extensive experience in core finance.

Most Detailed Curriculum

Our curriculum is THE MOST detailed across the Investment Banking training industry

100% Placement Assistance

After the course completion, students get access to our placement network of 200+ recruiters

Curriculum for Financial Modeling Course in Delhi

Our curriculum is the most detailed, concept driven and Industry relevant.

How do we cover the syllabus efficiently?

- Basic excel formulas as sum, product, division, multiplications, paste special,

- Sorting Data and using advanced filters

- Using conditional formatting

- Transpose

- Vlook Up/Hlook up

- Match, Index/ Offset Function

- Combination of multiple functions in a problem as Vlook +Match, Index+Match, VlookUp

- If, ifs and nested function

- Present value calculation

- CAGR Calculation

- Pivot Tables

- IRR, XIRR Calculation

- EMI calculator

- Sum if, Count if, Sumifs

- P&L account

- Balance sheet

- Cash flow statement

- Annual reports (10K), Quarterly reports (10Q), Earnings reports (8K), Proxy statements (14A)

- Inventory

- Working capital

- Deferred tax asset / Deferred tax liability

- Fixed assets

- Contingent liabilities

- Basic 3 statement model case study 1

- Basic 3 statement model case study 2

- Advanced 3 statement model

- Advanced 3 statement model

- 3 Statement model of public company

- Most efficient way to use PPT commands

- Setting up PowerPoint correctly

- Slide Master

- PowerPoint shortcuts

- Inserting aligning distributing shapes

- DCF valuation of Hindustan Unilever (Project)

- DCF valuation of Tesla (In Class)

- DCF valuation of Netflix (Project)

- DCF valuation of Apple (Project)

- Tracking Microsoft and LinkedIn deal (In Class)

- Tracking Kraft and Heinz merger (Project)

- Tracking acquisition of GrubHub by Just Eat (Project)

- Tracking Microsoft and Linkedin deal (In Class)

- Tracking Kraft and Heinz merger (Project)

- Tracking acquisition of GrubHub by Just Eat (Project)

- Microsoft and Linkedin deal

- Kraft and Heinz deal

- What is LBO?

- Why less LBOs in India?

- Characteristics of Ideal LBO candidate

- LBO basic model case study

- LBO advance model case study

- Trying to replicate Bristol Myers Squibb and Celgene Corp deal

- Understanding of banking industry (Regulatory capital, RBI norms, Creating of provision, Liquidity coverage ratio and Net Stable funding ratio projection)

- Projecting balance sheet of IDFC first bank

- Projecting Income statement of IDFC first bank

- Projecting cash flow of IDFC first bank

- Valuation of IDFC first bank

- Return on equity and return on assets

- Sensitivity analysis

- Pre-sold condo development model

- Hotel acquisition and renovation model

- Office acquisition and renovation model

- Overview of Oil and Gas companies

- Production overview

- Price realization

- Hedging revenue

- Expenses per Boe/Mcfe

- Income statement

- Balance sheet

- Cashflow statement

- Debt schedule

- Linking all statements

Real-World Valuation Case Studies of Leading Innovators

Gain unparalleled insights into the art of valuation and financial modeling with our meticulously crafted case studies.

Netflix

Delving into OTTs subscriber growth, content investment, and competitive positioning.

Tesla

Innovation-driven valuation and the impact of technology on market capitalization

ChatGPT

Assessing revenue models, growth trajectories, and the role of AI in market disruption

Jio Telecom

Pricing models, and impact on the tele- communications sector’s valuation landscape

Exclusive Content Access

Unlock Premium Resources: Your Comprehensive Investment Banking Toolkit

Investment Banking Handbook

A comprehensive guide covering the A-Z of investment banking, from fundamental concepts to advanced strategies.

Financial Model Templates

Ready-to-use Excel templates for various financial modeling scenarios, designed by industry veterans for real-world applications.

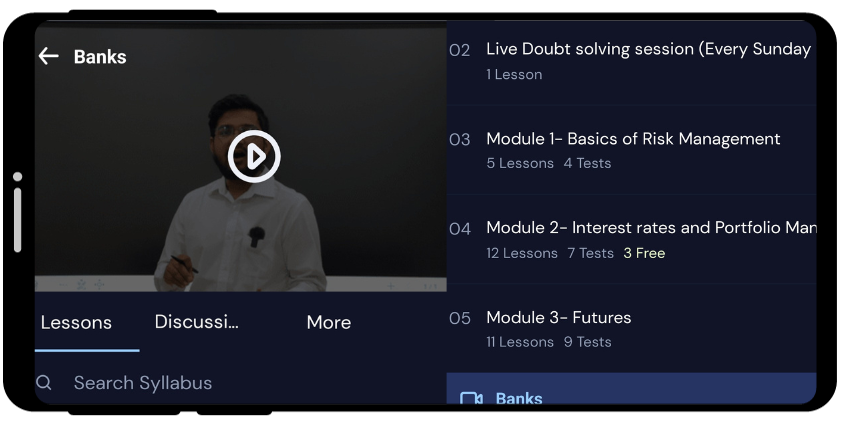

Mobile App With Up-to-Date Resources

Our Mobile Application provides instant access to all our study materials, updated regularly to reflect the latest industry trends

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge

Where we go the extra mile in Financial Modeling unlike any other

Offering

Others

24/7 Peer and Tutor Forums for immediate query resolution

Exclusive industry insights with current market trends

Continuous course updates, ensuring current content relevancy

Full Length Mock Interviews with ‘Near’ Job Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier finance professionals

Dedicated Faculty for last-minute doubt solving before Interview

Discover The Seamless Learning Experience

Our Platform's Features

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

Know Your Timeline

How to become an Investment banker?

Charting Your Path to Investment Banking: A Step-by-Step Journey with Quintedge

Our Faculty Members

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash Jain

Yash is a seasoned Investment Banking Trainer and Ex – Senior Associate at Bain & Co. specializing in Corporate Finance. He has trained over 5000 candidates till date and is renowned for his engaging sessions at prestigious institutions like IIT, Goldman Sachs, and NIFM.

Sudhanshu kanwar

Sudhanshu is a Global Markets Strategist, with a storied career at Goldman Sachs. His credentials, including CQF, FRM, and CFA, reflect his deep analytical acumen. As a member for the Harvard Review, he combines expertise with a passion for mentorship.

Rohit Sachdev

Rohit Sachdev is an adept Options Trader with extensive experience, specializing in both Fundamental and Technical Analysis. His background as an Investment Banker at Deutsche Bank and FRM Charterholder underscore his deep understanding of financial markets.

Ankita Agarwal

Ankita is a distinguished finance professional with a strong background in investment strategy and management. Having held significant positions at top-tier firms, she’s a CFA Charter holder. She is known for her interactive and insightful teaching approach.

Placements & Career Assistance

Placement Assistance Program

Crack Jobs At Best Finance Roles

Learn with real work experience and get placed at Top Finance & Accounting based Job Roles.

- Experiential Masterclasses by Investment Bankers

- AI Based Resume Maker Tool Trained by Industry Experts

- Interview Preparation AI tool based on 10,000 Questions asked in Real Interviews

- Job Opportunities in Core Finance Roles

Career Counseling

Personalized career guidance in identifying work goals and potential job roles

End-To-End

Extensive Support , starting from Job search, to getting the offer letter from Company

Access Duration

3 Months

Job Applications

Unlimited

Mock Interviews

Unlimited

AI Based Resume Drafting

3 Drafts

Monthly Masterclasses By Industry Experts

Makeing You Well Versed With Current Industry Trends

Industry Recognized Certification

Here's to our Achievements

Our Awesome Records

Over the years, our students’ satisfaction and the success rate are worth an eyeball.

Batches Taken

Countries

Positive Feedback

Past Students

Work At Big 4s, Investment Banks & MNCs

Build your Skillset with us and impress recruiters at Investment Banks, global MNCs, and Big 4s.

Financial Modeling Course in Delhi Testimonials

From the Past Candidates

Read on to know what our students have to say

Vaishali Jain

I was a CA working in an audit role when I joined Quintedge’s Investment Banking Course. The depth of knowledge included in their modules (Financial Modeling and Valuations) was exactly what’s needed in my dream profile i.e. Valuations. Without their guidance, it won’t have been possible for me to shortlist the companies and crack the interview.

Vikas Burakoti

Most other Investment Banking courses teach what I should call ‘Theory’ which has no relation with the requisite job skills. On the other hand, Yash sir is an Industry veteran, having tremendous exposure in the valuation field. His vast experience speaks when he teaches the concepts in the class with utmost detail and practical examples.

Akshay Gupta

Being from non-finance background, it was practically difficult for me to even understand basic financial models, let alone getting a Job in core finance. However, this course has been a career changer for me. Even the most basic concepts were explained from scratch so that all the students are par when the toughest Valuation topics started.

Financial Modeling Career, Scope & Salary

Let’s get to know how this qualification can shape your future and career.

Growth & Recognition

Financial Modeling is the most recognized and growth oriented core finance job due to the dynamic nature of the work.

Job Profiles

After completing our course, you can get a core finance job in Investment banking, Equity research, Valuations etc.

Median Salary

Although the salary depends upon you experience & education, the median CTC of an Investment Banker amounts to INR 12 LPA.

Fees & Variants of Financial Modeling Course in Delhi

Certification in Investment Banking

₹ 40,000

- 2.5 months of Live Training with Expert faculties and Hands on Practice

- Live Instructor Led Classes

- Access to Learning Portal with 180+ Hours of Video Content

- Real World case Studies

- Concept Wise Tests & Quizzes

- Discussion Forum Access

- Quintedge's In-house Financial Modeling Handbook

- Unlimited Doubt Solving

- Weekly Office Hours

Certification in Investment Banking

₹ 32,000

- 180 hours of Self Paced Training with Expert faculties and Hands on Practice

- Live Instructor Led Classes

- Access to Learning Portal with 180+ Hours of Video Content

- Real World case Studies

- Concept Wise Tests & Quizzes

- Discussion Forum Access

- Quintedge's In-house Financial Modeling Handbook

- Unlimited Doubt Solving

- Weekly Office Hours

Placement Assistance Program

3 Months of Extensive Placement Assistance for Certified Candidates

- Placement Support for core Finance Job Roles

- Monthly Industry Based Masterclasses

- AI Based Resume Maker & Interview Preparation Tool

Additional Fees

₹9,000

(For 3 Months)

Eligibility: Passing The Final Exam

AI Resume Evaluator

Want To Know Your Chances of Getting a Job in Core Finance?

Try out our Free AI Based Resume Evaluator Tool to know your chances of getting a Job in core Finance, and customized profile suggestions to increase them exponentially.

Have Doubts?

Know More About Financial Modeling

Unlock insights into the Financial Modeling – the gold standard in finance

Mastering Financial Modeling: The Ultimate Guide to Courses and Certification in Delhi

In the present competitive business environment, having strong financial modeling skills is a must-have for finance professionals. If you are a graduate or an experienced professional and planning to expand your skill set in the financial domain, then QuintEdge has the financial modeling certification course.

Explore everything you need to know about financial modeling courses and certifications, with a special focus on why we offer the best financial modeling course in Delhi.

Understanding Financial Modeling and Valuation Courses in Delhi

What Is Financial Modelling Course?

Financial modeling learning helps the learner develop skills in creating hypothetical models of a financial decision-making environment. These models help in forecasting future earnings based on past trends based on the assumptions and forecasts relating to future trends. A financial modeling and valuation course in Delhi comprises various topics such as financial statement analysis, forecasting, and valuation that will allow you to construct financial models.

Also Read – Different Financial Models

Financial modeling is a crucial skill for finance professionals as it helps to make decisions, analyze investments, and analyze the financial situation of a business. It is also widely used in banking, equity research, corporate finance, and consulting. One of the most interesting and well-paid professions related to financial modeling is that of finance.

Benefits of a Financial Modeling Certification

- Enhancing Credibility and Employability: Financial modeling certification proves to potential employers that you are able and that you are willing to be a better candidate for their company.

- Access to Better Job Opportunities and Higher Salaries: Aspirants who have the certification are more likely to have better career advancement opportunities and higher salaries than their non-certified counterparts.

How to Choose the Best Financial Modeling Course in Delhi?

When selecting the best financial modeling course in Delhi, consider the following factors:

- Ensure that all necessary topics are covered and exercises are available for the course.

- Choose courses that are conducted by professionals who have real-world experience in the sphere of finance.

- Select courses that either have online classrooms or modules.

- Choose courses that are highly valued and esteemed in the finance world.

Why Choose QuintEdge for Financial Modeling Course in Delhi?

A financial modeling and valuation course in Delhi can provide you with the skills and knowledge that you may need to achieve your goals. Financial modeling certification will also assist you in getting a better job or enhancing your career opportunities. QuintEdge is the best place to learn financial modeling in Delhi because it offers a detailed course curriculum, experienced trainers, and career assistance.

QuintEdge is the best financial modeling and valuation course provider in Delhi. Not only financial modeling but they are the best institute for acca coaching classes in Delhi, FRM coaching program in Delhi, CFA coaching program in Delhi, and even investment banking program in Delhi.

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

A Financial Modeling and Valuation course teaches you how to build professional financial models and perform valuation analysis. It covers essential concepts like discounted cash flow (DCF) valuation, comparative company analysis, and advanced Excel functions.

To apply for our Live Program, you can call up our counsellors and they will guide you with the registration process.

Yes, basic accounting knowledge is required. That’s thy we give pre-lecture study material so that students get a strong hold of the concepts delivered in the class.

This course is perfect for finance professionals, analysts, investment bankers, corporate finance managers, and anyone keen on mastering financial modeling and valuation techniques.

Graduates can pursue careers in investment banking, equity research, financial consultancy, corporate finance, and asset management. The skills acquired are also valuable for entrepreneurial ventures and other finance-related fields.

In live course, there will be 80 classes of 3 hours each in the Live course, amounting to total 240 hours of training. The recorded Course will be around 150 hours long.

No, we don’t because a Job offer depends upon multiplicity of factors. However, rest assured that ample placement opportunities will be given in core finance roles.

After completing this certification, one can get a Job in core finance profiles such as Valuations, Investment Banking, Portfolio Management etc.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.