Financial models are essential tools that help businesses and investors make informed decisions by providing insights into an organization’s financial health and potential risks.

This comprehensive guide will cover various types of financial models, their uses, and key components to help you better understand how they contribute to strategic decision-making.

What is Financial Modeling?

Financial modeling is the process of creating a mathematical representation of a company’s financial situation, typically using historical data, assumptions, and projections.

These models help businesses make data-driven decisions, evaluate investment opportunities, and plan for future growth. The key components of a financial model include income statements, balance sheets, cash flow statements, and key financial ratios.

Purpose of making Financial Models

- Making Company decisions – Management, treasury, strategy teams of the company use financial models to make future decisions for the company.

- Pricing securities – If a company wants to issue fresh securities or debt, they use financial models to price them.

- Corporate transactions – Investment banking is closely related to mergers, acquisitions, private equity and hence analyst spend immense time building financial models to help with these decisions.

- Investment decisions – Financial modelling can help in evaluating and forecasting outputs/ returns of investments of a company.

Also Read: How to Make a Financial Model – Step by Step Guide

Types of Financial Models

There are various types of financial models based on the need for the models or the purpose that they would serve but listed below are the most commonly used and well-known types of financial models –

Three Statement Model

The Three Statement Model is a financial model that combines a company’s income statement, balance sheet, and cash flow statement into a single, integrated framework. This model helps you analyze a company’s financial performance, understand the relationships between the three statements, and evaluate how changes in one statement may impact the others.

It’s a crucial tool for financial analysis, valuation, and decision-making in various contexts, such as investing, budgeting, and forecasting.

Example / Use case

Let’s say you’re an analyst who wants to create a Three Statement Model for Company Z to assess its financial performance and make investment decisions. To do this, you would follow these steps:

Step 1: Gather historical financial statements – Collect Company Z’s historical financial statements, including the income statement, balance sheet, and cash flow statement. This information will serve as the basis for your model.

Step 2: Format and link the financial statements – Arrange the financial statements in a consistent format and link them together, so changes in one statement will automatically flow through to the others. This involves connecting line items like net income, changes in working capital, and changes in long-term assets and liabilities.

For example, net income from the income statement should flow into the cash flow statement and be added to retained earnings on the balance sheet.

Step 3: Analyze historical financial performance – Examine the historical financial statements to identify trends, assess the company’s financial health, and understand the drivers of its performance. This may include calculating financial ratios, analyzing growth rates, and evaluating profitability and liquidity.

Step 4: Develop assumptions for future performance – Based on your analysis of historical performance and any other relevant information (e.g., industry trends, economic conditions), develop assumptions for the company’s future financial performance. This may include assumptions about revenue growth, expense trends, and changes in working capital.

Step 5: Forecast future financial statements – Using your assumptions, project the company’s future income statement, balance sheet, and cash flow statement. The forecast should be consistent with your assumptions and reflect the relationships between the three financial statements.

Step 6: Conduct sensitivity and scenario analysis – Test the impact of different assumptions and scenarios on the company’s projected financial performance. This can help you understand the potential risks and opportunities associated with your investment decision.

For example, you might analyze the impact of a higher or lower revenue growth rate, or the effect of changes in the company’s cost structure.

By following these steps, you can use a Three Statement Model to analyze a company’s financial performance, understand the relationships between the financial statements, and evaluate the potential impact of changes in key assumptions. This information can help you make informed investment decisions and assess the company’s financial health and prospects.

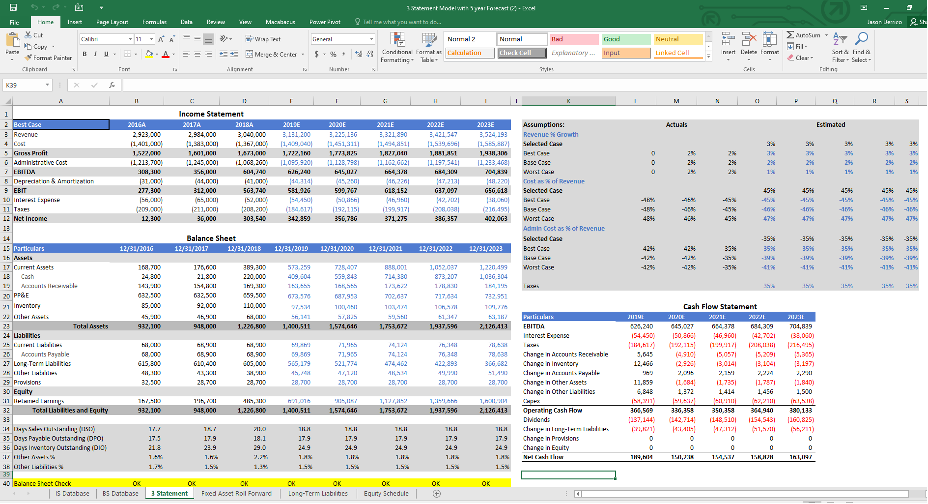

(The picture shows historical data and forecasted figures in all three statements – Income, Balance sheets and cash flow statements)

Discounted Cash Flow (DCF) Model

Imagine you’re considering investing in a business, and you want to know how much that investment is worth today. The Discounted Cash Flow (DCF) model helps you do that by estimating the future cash flows the business is expected to generate and then “discounting” those cash flows back to their present value.

In simpler terms, it tells you how much future money is worth today, considering that money’s value decreases over time (due to factors like inflation and risk).

Example / Use case

Let’s say you’re thinking about investing in a small bakery. To determine its value, you would follow these steps using the DCF model:

Step 1: Forecast cash flows – Estimate the bakery’s future cash flows for the next few years. This could be based on factors like historical sales, growth projections, and the local market.

For example, you might estimate the following cash flows:

- Year 1: $20,000

- Year 2: $25,000

- Year 3: $30,000

- Year 4: $35,000

- Year 5: $40,000

Step 2: Determine the discount rate – Calculate the required rate of return based on the risk associated with the investment. This rate reflects the minimum return you would accept to invest in the bakery instead of a less risky alternative, like a government bond.

For example, let’s say you decide on a discount rate of 10%.

Step 3: Calculate the present value – Discount future cash flows to their present value using the discount rate. This involves dividing each cash flow by (1 + discount rate) raised to the power of the number of years into the future.

For example, the present value of the Year 1 cash flow would be: $20,000 / (1 + 0.10)^1 = $18,182

You would repeat this calculation for each year’s cash flow and sum the present values to arrive at the total present value of the future cash flows.

Step 4: Estimate the terminal value – Calculate the value of cash flows beyond the forecast period (Years 1-5). This is often done using a “terminal growth rate,” which is a constant rate at which cash flows are assumed to grow indefinitely.

For example, let’s say you assume a terminal growth rate of 2%. You would calculate the terminal value as follows: Terminal Value = Year 5 cash flow * (1 + terminal growth rate) / (discount rate – terminal growth rate) = $40,000 * (1 + 0.02) / (0.10 – 0.02) = $510,000

Then, you would discount the terminal value back to its present value and add it to the total present value of the future cash flows to get the overall value of the bakery.

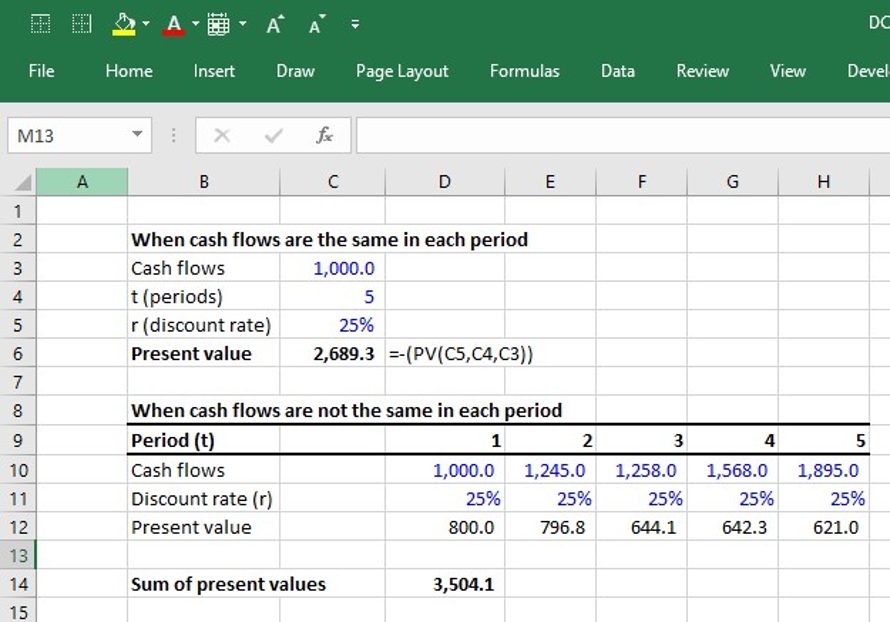

(In this picture below, we can see a very basic example of the DCF model, the cash flows of years 1 to 5 are discounted by a discount rate to its present value)

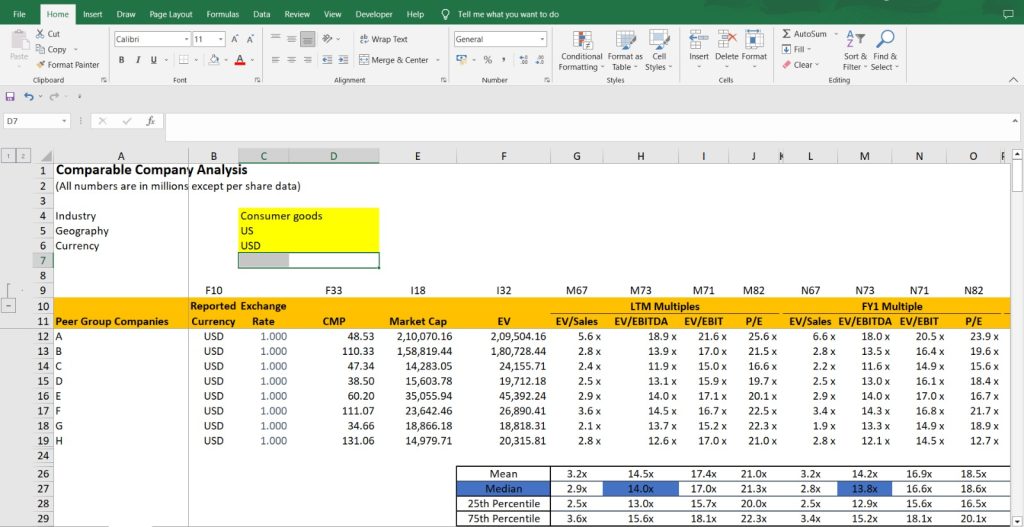

Comparable Company Analysis (CCA) Model

Imagine you want to buy a house, and you’re trying to determine how much it’s worth. One common approach is to look at similar houses in the neighborhood and compare their prices. Comparable Company Analysis (CCA) works in a similar way, but for businesses.

It helps you estimate the value of a company by comparing it to other similar companies in the same industry. This method is based on the idea that companies with similar characteristics should have similar valuations.

Example / Use case

Let’s say you’re considering investing in a small software company and want to estimate its value using the CCA model. To do this, you would follow these steps:

Step 1: Identify comparable companies – Find other software companies that are similar to the one you’re interested in, considering factors like size, growth, and profitability. Ideally, you should find publicly traded companies since their financial information is readily available.

For example, you might select three other small software companies as comparables.

Step 2: Choose valuation multiples – Select financial ratios, called valuation multiples, that will help you compare the companies. Commonly used multiples in CCA include Price-to-Earnings (P/E) ratio, Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Sales (P/S) ratio. These multiples help you compare the value of companies relative to their earnings, cash flow, or sales.

For example, let’s say you decide to use the P/E ratio.

Step 3: Calculate the multiples for the comparable companies – Compute the valuation multiples for each comparable company using their financial data. For example, the P/E ratio is calculated by dividing the company’s stock price by its earnings per share (EPS).

Let’s say the three comparable software companies have P/E ratios of 15, 20, and 25.

Step 4: Determine the target company’s valuation multiple – Calculate the average or median valuation multiple of the comparable companies. This will be used as a benchmark for valuing the target software company.

In our example, the average P/E ratio of the comparable companies is (15 + 20 + 25) / 3 = 20.

Step 5: Estimate the target company’s value – Multiply the target company’s financial metric (in our case, earnings per share) by the benchmark valuation multiple to estimate its value.

For example, if the target software company has an EPS of $2, its estimated value using the CCA model would be: Value = P/E ratio * EPS = 20 * $2 = $40 per share

By following these steps, you can use the CCA model to estimate the value of a company based on the valuations of similar companies in its industry.

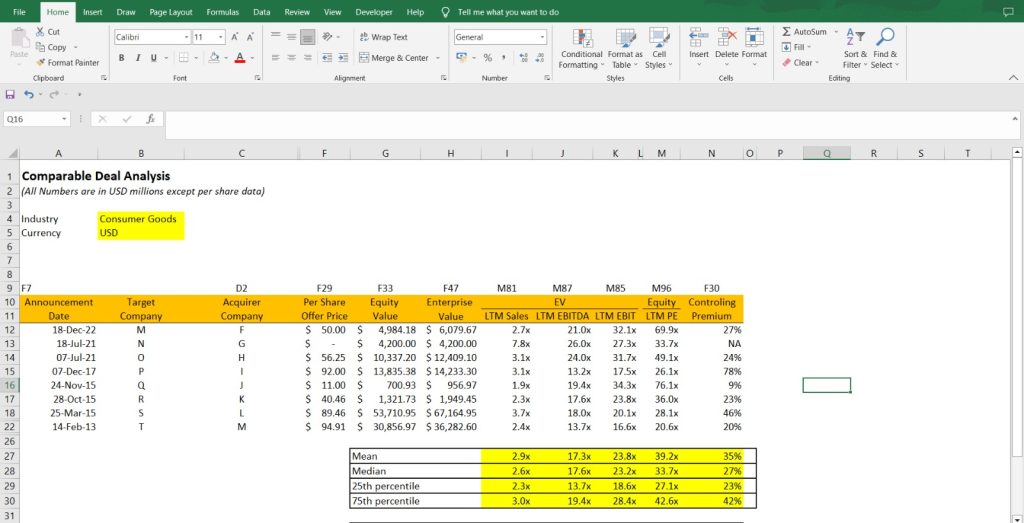

Precedent Transaction Analysis (PTA) Model

When you’re trying to figure out how much you should pay for something, it’s often helpful to look at the prices that others have paid for similar items in the past. Precedent Transaction Analysis (PTA) applies this concept to valuing businesses by examining the prices paid in previous transactions involving similar companies.

By analyzing these past deals, you can get a sense of the fair value for the company you’re interested in.

Example / Use case

Suppose you’re considering acquiring a small restaurant and want to estimate its value using the PTA model. To do this, you would follow these steps:

Step 1: Identify precedent transactions – Find past deals involving the acquisition of similar restaurants, considering factors like size, location, and type of cuisine. These transactions will serve as a basis for comparison.

For example, you might find three precedent transactions involving the acquisition of small restaurants in your area.

Step 2: Choose valuation multiples – Select financial ratios, called valuation multiples, to compare the transactions. Common multiples used in PTA include Enterprise Value-to-Revenue (EV/Revenue), Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Earnings (P/E) ratio. These multiples help you compare the value of companies relative to their sales, cash flow, or earnings.

For example, let’s say you decide to use the EV/Revenue multiple.

Step 3: Calculate the multiples for the precedent transactions – Compute the valuation multiples for each precedent transaction using the deal information. For instance, the EV/Revenue multiple is calculated by dividing the transaction’s enterprise value (purchase price plus debt) by the target company’s revenue.

Let’s say the three precedent transactions have EV/Revenue multiples of 0.8, 1.0, and 1.2.

Step 4: Determine the benchmark valuation multiple – Calculate the average or median valuation multiple of the precedent transactions. This will be used as a benchmark for valuing the target restaurant.

In our example, the average EV/Revenue multiple of the precedent transactions is (0.8 + 1.0 + 1.2) / 3 = 1.0.

Step 5: Estimate the target restaurant’s value – Multiply the target restaurant’s financial metric (in our case, revenue) by the benchmark valuation multiple to estimate its value.

For example, if the target restaurant has annual revenue of $500,000, its estimated value using the PTA model would be: Value = EV/Revenue multiple * Revenue = 1.0 * $500,000 = $500,000

By following these steps, you can use the PTA model to estimate the value of a company based on the valuations of similar companies in previous transactions.

Leveraged Buyout (LBO) Model

Imagine you want to buy a house, but you don’t have enough money to pay for it in cash. Instead, you take out a mortgage to cover most of the cost and make a down payment with your own money. This is similar to how a Leveraged Buyout (LBO) works in the business world.

In an LBO, an investor (usually a private equity firm) acquires a company using a combination of their own funds (equity) and borrowed money (debt). The LBO model is used to analyze the potential returns from such an investment and to determine how much the investor can afford to pay for the target company while still achieving their desired rate of return.

Example / Use case

Let’s say you’re a private equity firm considering an LBO of a small manufacturing company. To estimate the potential returns and maximum purchase price using the LBO model, you would follow these steps:

Step 1: Forecast the target company’s cash flows – Estimate the manufacturing company’s future cash flows for the investment period (e.g., five years). This could be based on factors like historical financial performance, growth projections, and industry trends.

Step 2: Determine the financing structure – Decide on the mix of debt and equity you’ll use to finance the LBO. This will depend on factors like the target company’s cash flow, the availability of financing, and your desired level of risk.

For example, let’s say you plan to finance the LBO with 70% debt and 30% equity.

Step 3: Estimate the debt repayment schedule – Based on the financing structure, calculate the annual debt repayments the company will need to make. The borrowed money is usually paid back using the target company’s cash flows.

Step 4: Calculate the exit value – Estimate the value of the target company at the end of the investment period. This is often done by applying a valuation multiple (e.g., EV/EBITDA) to the company’s projected financial metrics.

For example, let’s say you expect the company’s EBITDA to be $10 million at the end of Year 5, and you apply an exit multiple of 8x. The exit value would be $80 million.

Step 5: Calculate the potential return on investment (ROI) – Determine the potential ROI by considering the initial investment, the debt repayment, and the exit value. This will help you evaluate the attractiveness of the LBO opportunity.

For example, let’s say the initial investment (equity) is $15 million, and at the end of Year 5, the company has repaid all its debt. The potential return would be: ROI = (Exit Value – Initial Investment) / Initial Investment = ($80 million – $15 million) / $15 million = 433%

Step 6: Assess the maximum purchase price – Based on your desired rate of return, calculate the maximum purchase price you can afford to pay for the target company while still achieving that return.

By following these steps, you can use the LBO model to evaluate the potential returns from a leveraged buyout and determine the maximum price you can afford to pay for the target company.

Mergers and Acquisitions (M&A) Model

In the business world, companies sometimes decide to join forces by merging or acquiring one another to create a stronger, more competitive entity. A Mergers and Acquisitions (M&A) model helps you analyze the financial implications of such a deal by estimating the combined value of the two companies and determining whether the deal would create value for the shareholders.

This model is used to ensure that the transaction makes financial sense and to identify any potential synergies or cost savings that could result from the deal.

Example / Use case

Let’s say you’re the CFO of Company A, and you’re considering acquiring Company B. To analyze the potential financial impact of this acquisition using the M&A model, you would follow these steps:

Step 1: Gather financial data – Collect the financial data for both companies, including balance sheets, income statements, and cash flow statements. You’ll need this information to create pro forma financial statements, which show the combined financial performance of the two companies as if they were already merged.

Step 2: Estimate synergies and cost savings – Identify potential synergies and cost savings that could result from the acquisition. Synergies are benefits that arise when two companies combine, such as increased market share, improved operational efficiency, or reduced costs.

For example, you might identify the following synergies:

- Reduction in duplicate administrative functions

- Streamlined supply chain management

- Increased bargaining power with suppliers

Step 3: Create pro forma financial statements – Combine the financial data of both companies and adjust for any synergies and cost savings to create pro forma financial statements. This will give you an idea of the combined company’s financial performance.

Step 4: Determine the purchase price and deal structure – Decide on the price you’re willing to pay for Company B and the structure of the deal (e.g., cash, stock, or a combination of both). This will depend on factors like the target company’s financial performance, growth prospects, and the potential synergies.

Step 5: Calculate the accretion/dilution – Determine whether the acquisition would be accretive or dilutive to Company A’s earnings per share (EPS). Accretive deals increase EPS, while dilutive deals decrease EPS. This calculation helps you understand the impact of the acquisition on your shareholders’ value.

For example, let’s say Company A’s EPS before the acquisition is $2.00, and the pro forma EPS after the acquisition is $2.20. The deal would be accretive, as the combined EPS is higher than Company A’s standalone EPS.

Step 6: Evaluate the deal – Based on the pro forma financial statements and the accretion/dilution analysis, assess whether the acquisition would create value for Company A’s shareholders and if it aligns with the company’s strategic goals.

By following these steps, you can use the M&A model to analyze the financial implications of a merger or acquisition and determine whether the deal makes financial sense for both companies involved.

Budgeting and Forecasting Model

A budget is a financial plan that outlines a company’s expected revenues, expenses, and cash flows over a specific period, usually a year. Budgeting helps companies allocate resources, control spending, and track financial performance. Forecasting, on the other hand, involves predicting a company’s future financial performance based on historical data, market trends, and management’s expectations.

A Budgeting and Forecasting Model combines these two processes to help companies create a comprehensive financial plan, set performance targets, and monitor progress throughout the year.

Example / Use case

Let’s say you’re a small business owner who wants to create a budget and forecast for the upcoming year using a Budgeting and Forecasting Model. To do this, you would follow these steps:

Step 1: Gather historical financial data – Collect your company’s historical financial data, including revenues, expenses, and cash flows. This information will serve as the basis for your budget and forecast.

Step 2: Analyze trends and external factors – Identify any trends in your company’s financial performance, as well as external factors that may impact future results, such as changes in the industry, economic conditions, or new regulations.

Step 3: Set revenue and expense assumptions – Based on your analysis, set assumptions for future revenues and expenses. These assumptions could include factors like expected sales growth, changes in the cost of goods sold, and anticipated operating expenses.

For example, you might assume that your sales will grow by 10% next year, your cost of goods sold will remain at 60% of sales, and your operating expenses will increase by 5%.

Step 4: Create the budget – Using your revenue and expense assumptions, create a detailed budget for the upcoming year. This should include line items for all expected income and expenditures, along with a projected cash flow statement.

Step 5: Develop the forecast – Create a forecast for the upcoming year based on your budget and any additional information or expectations not captured in the budget. The forecast should be updated regularly (e.g., monthly or quarterly) to reflect actual performance and any changes in assumptions or market conditions.

Step 6: Monitor and adjust – Throughout the year, compare your actual financial performance to your budget and forecast. Identify any variances and analyze the reasons for these differences. If necessary, make adjustments to your budget or forecast to ensure you remain on track to achieve your financial goals.

By following these steps, you can use a Budgeting and Forecasting Model to create a comprehensive financial plan for your business, set performance targets, and monitor progress throughout the year. This process helps you allocate resources efficiently, control spending, and make informed decisions about your company’s future growth and profitability.

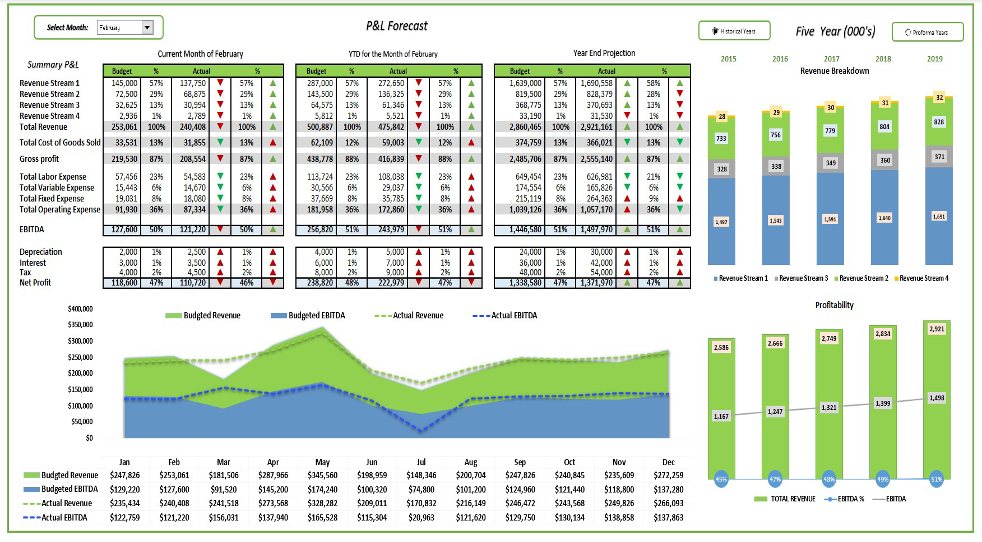

(In the picture we can see historical financial figures for the month of February and based on those projections being made for the entire year for the company)

Factors to consider when selecting a financial model

- Purpose and objectives: Consider the specific goals and context of the analysis.

- Industry and company characteristics: Assess the nature of the business and its industry dynamics.

- Available data and information: Evaluate the quality and quantity of financial data available.

- Complexity and resources: Balance the complexity of the model with the time and resources required to prepare and maintain it.

Tips for enhancing financial modeling expertise

- Master spreadsheet functions and shortcuts: Improve your efficiency and effectiveness in financial modeling by mastering spreadsheet functions and shortcuts.

- Develop a logical and structured approach: Organize your models in a clear and logical manner to enhance their readability and usability.

- Validate and cross-check your models: Regularly review and validate your models for accuracy and consistency, and cross-check your calculations to ensure their reliability.

Conclusion

In conclusion, understanding the different types of financial models is crucial for effective decision-making in both personal and professional contexts. By choosing the right model for your specific needs and continuously improving your financial modeling skills, you can better evaluate investment opportunities, plan for future growth, and make informed decisions that contribute to long-term success.

Financial models are powerful tools that, when used correctly, can unlock valuable insights and help drive strategic decision-making. So, take the time to explore and master these various financial modeling techniques to enhance your financial analysis capabilities and ensure you are well-equipped to navigate the ever-evolving world of finance.

Frequently Asked Questions

DCF is a mostly used type of financial model.

MS Excel is widely used for the purpose of financial modelling. One can also use MS PowerPoint to depict the outcomes of financial modelling