In the world of accounting and finance, professional qualifications are key to unlocking career opportunities, and the ACCA (Association of Chartered Certified Accountants) is one of the most globally recognized credentials. With over 227,000 members and 544,000 students in 180 countries, ACCA is highly sought after by those aiming for success in accounting, auditing, and finance.

However, for a candidate to undergo the qualification process and be certified by the ACCA, one has to write exams, also pass through an experience, development, and ethics assessment process. This is where ACCA Approved Employers feature, providing guided support to students and members, who strive to achieve training and mentoring standards supported by ACCA across the globe.

In this blog, we will explore why it is important to work for an ACCA Approved Employer and how it can fast-track your career progress. We’ll also discuss why becoming part of an ACCA Approved Employer is crucial if you’re pursuing a career in the finance industry.

What is ACCA?

The Association of Chartered Certified Accountants (ACCA) is a globally recognized professional accounting body that offers one of the most prestigious qualifications in finance and accounting. With over 227,000 members and 544,000 students in 180 countries, ACCA is renowned for providing a comprehensive and rigorous curriculum that covers accounting principles, taxation, auditing, financial management, and ethics. The ACCA qualification equips professionals with the skills and knowledge necessary to excel in various roles, including accounting, auditing, consulting, and financial management.

To understand more about the ACCA course in detail, read- All About the ACCA Course

What is an ACCA Approved Employer?

An ACCA Approved Employer is an organization officially recognized by the Association of Chartered Certified Accountants (ACCA) for its commitment to providing high-quality training, development, and support to ACCA students and members. This recognition is awarded to employers who meet ACCA’s stringent standards, ensuring their employees receive the necessary guidance, mentorship, and resources to achieve their professional goals.

What Sets ACCA Approved Employers Apart?

Being an ACCA Approved Employer means that the organization goes beyond the standard expectations of employee support. It commits to the professional development of its ACCA employees through well-structured training programs, ethical work environments, and access to resources that facilitate career progression. Here’s what distinguishes these employers:

Structured Learning and Development:

- ACCA Approved Employers ensure their employees receive formal training that directly aligns with ACCA’s performance objectives.

- This structured training approach is tailored to help ACCA students gain the practical experience they need to qualify, while also providing continual professional development opportunities for qualified ACCA members.

Exemptions from Performance Objectives for ACCA Students:

- Typically, ACCA students need to complete specific performance objectives to fulfill ACCA’s practical experience requirements. However, ACCA Approved Employers offer an exemption from this process.

- This means that ACCA students working at these organizations do not need to manually record their performance objectives, as the employer’s training programs are recognized as sufficient to meet ACCA’s practical experience standards.

Support for CPD (Continuing Professional Development):

- For ACCA members, maintaining their qualification requires the completion of annual Continuing Professional Development (CPD) hours.

- ACCA Approved Employers often offer structured CPD support, ensuring that employees can fulfill their requirements through company-provided training sessions, workshops, and other professional development activities.

High Ethical and Professional Standards:

- ACCA Approved Employers adhere to the same ethical principles as the ACCA itself. They create an environment that supports ethical decision-making and professional conduct, which is fundamental to ACCA’s values.

- This ensures that employees are not only trained in technical skills but also operate with integrity in their professional responsibilities.

Types of ACCA Approved Employers

ACCA offers different types of approval based on the level of support provided by the organization:

Training and Development Approved Employers:

- These organizations are recognized for their commitment to the comprehensive development of ACCA students.

- They provide structured training programs that allow students to gain practical experience while working toward their ACCA qualification.

- This type of approval helps students fulfill the work experience requirements necessary for completing the ACCA qualification.

Professional Development Approved Employers:

- These employers focus on supporting qualified ACCA members in meeting their CPD obligations.

- They offer various opportunities for members to expand their knowledge, skills, and competencies to stay current in a rapidly changing financial and regulatory environment.

Why It Matters for Employees?

Being an ACCA Approved Employer benefits its employees in several ways:

Fast-Tracked Career Growth:

- ACCA Approved Employers provide structured training and development that helps employees complete their qualification requirements more efficiently.

- The formal mentoring and training programs offered by these employers significantly improve the chances of success.

Exemptions and Support:

- As mentioned, ACCA students can benefit from exemptions from performance objectives, while members receive strong CPD support, making it easier to maintain their ACCA qualification.

Global Recognition:

- ACCA Approved Employers are part of a globally recognized network.

- Working for one of these organizations signals to future employers that you have received high-quality training and support, boosting your employability on a global scale.

How Employers Become ACCA Approved?

So, how does a company gain the status of an ACCA Approved Employer? The process is comprehensive, ensuring that only companies with the highest training and development standards qualify.

Step-by-Step Process

- Application: The employer must submit a detailed application showcasing their training and development framework.

- Assessment: ACCA reviews the company’s structure, support for employees pursuing ACCA, and alignment with ACCA’s ethical and professional standards.

- Approval: Once approved, the employer must maintain the ACCA standards through periodic assessments to retain their status.

Key Criteria for Approval

- Ethical Standards: Organizations must adhere to high ethical standards and promote an environment that aligns with ACCA’s core values of integrity and professionalism.

- Learning and Development Framework: Employers must offer structured learning environments, including mentorship and coaching programs.

- Work Experience: Employers should provide relevant work experience that aligns with ACCA’s performance objectives and competencies.

Top Industries and Companies Hiring ACCA Professionals

The ACCA qualification is globally recognized, making ACCA professionals highly sought after across a wide range of industries. Organizations that are ACCA Approved Employers actively look for ACCA students, affiliates, and members to fill roles in finance, accounting, taxation, management, and consulting. Let’s explore the key industries where ACCA professionals are in high demand and some of the top global companies that hire them.

Key Industries Hiring ACCA Professionals

ACCA professionals are in demand across multiple sectors, thanks to the versatility of the qualification and the wide range of skills it imparts. Here are some of the top industries where ACCA professionals can find rewarding career opportunities:

Accounting and Taxation

- Accounting and taxation firms are one of the most obvious destinations for ACCA professionals.

- From large multinational firms to smaller boutique practices, accountants and tax experts are required to ensure compliance with international accounting standards, financial reporting regulations, and internal control systems.

Roles: Financial Accountant, Management Accountant, Tax Consultant.

Banking and Financial Services

- The banking and financial services sector relies heavily on skilled finance professionals to manage financial planning, risk, and regulatory compliance.

- ACCA professionals are well-positioned to work in corporate finance, investment banking, retail banking, and insurance.

Roles: Financial Analyst, Risk Manager, Compliance Officer, Treasury Analyst.

Consulting

- The demand for financial consultants, especially those who are ACCA-qualified, is growing rapidly.

- Consulting firms hire ACCA professionals to advise businesses on accounting standards, taxation, corporate finance, and financial risk management.

Roles: Business Consultant, Financial Advisor, Management Consultant.

Corporate Finance

- ACCA professionals can also be found in corporate finance departments across various industries.

- From handling mergers and acquisitions to budgeting and financial reporting, their expertise helps companies make informed strategic decisions.

Roles: Corporate Treasurer, Financial Controller, Chief Financial Officer (CFO), Financial Planning and Analysis Manager.

Public Sector and Government

- The public sector requires accountants to manage budgets, audits, and financial reporting in compliance with local and international regulations.

- ACCA professionals are valued for their ability to ensure accountability and transparency in financial management.

Roles: Public Sector Accountant, Financial Analyst, Financial Manager.

Energy, Oil & Gas

- The energy sector, including oil and gas companies, operates in a highly regulated environment that requires accurate financial reporting and risk management.

- ACCA professionals are vital in handling tax planning, capital investments, and regulatory compliance.

Roles: Financial Analyst, Investment Manager, Risk Manager.

Manufacturing and Retail

- ACCA professionals in manufacturing and retail industries are involved in budgeting, financial planning, and supply chain management.

- Their role is crucial in managing costs, maximizing efficiency, and ensuring profitability.

Roles: Cost Accountant, Financial Controller, Budget Analyst, Inventory Accountant.

Technology and Telecoms

- The tech and telecom sectors are expanding rapidly, creating more opportunities for finance professionals to manage their complex financial operations.

- ACCA professionals are valued for their ability to provide accurate financial insights, manage budgets, and handle investor relations.

Roles: Financial Planning Analyst, Corporate Finance Executive, Investment Strategist.

Top Global Companies Hiring ACCA Professionals

Several leading organizations across these industries are ACCA Approved Employers, offering robust career paths for ACCA-qualified professionals. These companies are known for their commitment to employee development and the global recognition that comes with being ACCA-approved. Here are some of the top companies that actively hire ACCA professionals:

- Deloitte: Deloitte is a major player in accounting, consulting, tax advisory, and risk management. They are always on the lookout for ACCA-qualified professionals to join their global team of experts and financial consultants.

- PwC: PwC offers a wide range of roles, from taxation and assurance to consulting and deal advisory. Their ACCA Approved Employer status ensures top-quality training and CPD support for finance professionals.

- KPMG: KPMG is a global leader in tax advisory and auditing services, providing ACCA professionals with excellent career growth opportunities and access to cutting-edge financial solutions.

- EY: EY (Ernst & Young) hires ACCA professionals for roles in assurance, advisory, and tax services, with a strong emphasis on development and global career opportunities.

- HSBC: As a leading multinational bank, HSBC is an ACCA Approved Employer that offers opportunities for ACCA professionals in corporate banking, retail banking, risk management, and financial planning.

- Standard Chartered Bank: is another major global bank that seeks out ACCA professionals for its roles in accounting, risk management, treasury, and corporate finance.

- Unilever: A global leader in fast-moving consumer goods (FMCG), recruits ACCA professionals to manage its financial planning, budgeting, and performance analysis.

- Nestlé: As the world’s largest food and beverage company, Nestlé hires ACCA professionals for roles in financial management, taxation, and corporate finance.

- BP (British Petroleum): BP is a global leader in the energy sector and an ACCA Approved Employer. They offer finance roles that involve managing large-scale investments, corporate finance, and taxation, making it a prime choice for ACCA professionals.

- Shell: Another major energy company, Shell, hires ACCA professionals for finance roles ranging from treasury management to corporate finance and financial reporting. The company’s global operations ensure that employees gain exposure to international financial practices and regulations.

- GlaxoSmithKline (GSK): GSK, one of the largest pharmaceutical companies in the world, employs ACCA professionals to manage its global financial operations.

- Vodafone: In the fast-growing telecoms industry, Vodafone hires ACCA professionals for roles in financial reporting, budgeting, risk management, and corporate finance.

- Accenture: A global consulting firm, is also an ACCA Approved Employer. The company hires ACCA professionals for various roles in management consulting, financial advisory, and corporate finance, offering a dynamic work environment with global exposure.

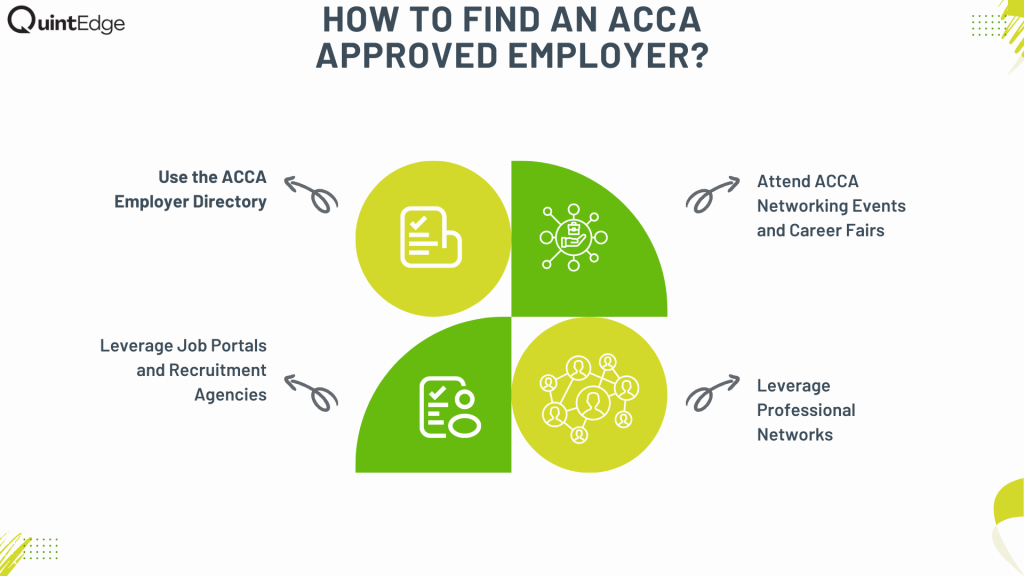

How to Find an ACCA Approved Employer?

Finding the right ACCA Approved Employer can significantly accelerate your journey to becoming an ACCA-qualified professional. These employers offer structured support, mentorship, and valuable training that align with ACCA’s standards. Whether you’re an ACCA student, affiliate, or member, here are several ways to find an ACCA Approved Employer to support your career development.

Use the ACCA Employer Directory

The easiest and most reliable way to find ACCA Approved Employers is through the ACCA Employer Directory available on the ACCA website. This directory is a comprehensive list of organizations worldwide that have been recognized by ACCA for their commitment to supporting ACCA students and members.

How to Use It?

- Visit the ACCA website and navigate to the Approved Employer Directory.

- Use the search filters to refine your search by region, country, industry, or employer type (whether they provide training for students or offer CPD support for members).

- The directory provides contact details and information about the employer’s ACCA accreditation, making it easy to identify potential employers in your area or field of interest.

Leverage Job Portals and Recruitment Agencies

Many job portals and recruitment agencies specialize in placing ACCA-qualified professionals and students in roles with ACCA Approved Employers. You can use these platforms to find open positions at ACCA Approved Employers in your desired industry or region.

- Recruitment Agencies: Specialized finance recruitment agencies often work closely with ACCA Approved Employers to fill roles that require ACCA qualifications.

- Online Job Platforms: Platforms such as LinkedIn, Indeed, and Glassdoor allow you to filter job listings by companies that support ACCA training or are listed as ACCA Approved Employers.

Attend ACCA Networking Events and Career Fairs

ACCA regularly hosts networking events, career fairs, and webinars that connect students and members with ACCA Approved Employers. These events are an excellent opportunity to meet employers face-to-face, learn about their work environments, and discuss potential job openings.

- Career Fairs: ACCA organizes career fairs where approved employers set up booths to interact with ACCA students and members. These events provide a platform to directly inquire about roles, company culture, and development programs that the employer offers.

- Networking Events: ACCA networking events are a great way to connect with fellow professionals and potential employers in your region or industry. Many ACCA Approved Employers attend these events to scout for talent, giving you the chance to make a direct impression.

Leverage Professional Networks

Networking with other ACCA professionals is a valuable way to learn about ACCA Approved Employers. Many ACCA members and students actively share job openings and employer experiences within their professional networks.

- LinkedIn: Join ACCA-related groups and networks on LinkedIn to stay informed about job openings, industry trends, and opportunities with ACCA Approved Employers. ACCA members often share vacancies in these groups, offering leads on potential employers.

- ACCA Local Chapters: Participate in local ACCA chapters or alumni networks. These communities frequently organize events where you can connect with fellow ACCA professionals and gain insights into which employers offer the best support for ACCA students and members.

- Mentorship and Alumni: Reach out to ACCA alumni or mentors who are already working at ACCA Approved Employers. They can provide recommendations, guidance on application processes, and may even refer you to suitable roles within their organizations.

ACCA vs Other Financial Certifications in India

Choosing the right financial certification is crucial for your career. In India, options like ACCA, CA, CFA, and CIMA are globally recognized, but each has unique benefits and relevance depending on your goals. Here’s a comparison of ACCA with other major financial certifications to help you make an informed choice.

ACCA vs CA

The CA qualification, administered by ICAI, is highly respected in India for careers in auditing, taxation, and accounting. ACCA, however, offers a globally recognized alternative with broader international opportunities.

Global Recognition:

ACCA: Recognized in over 170 countries, making it ideal for students seeking global career opportunities. ACCA-qualified professionals can work in various international markets without needing additional qualifications.

CA: Primarily focused on Indian taxation laws, accounting standards, and auditing practices, CA is recognized and preferred in India, but additional certifications may be required to practice in other countries.

Syllabus Focus:

ACCA: Covers a wide range of topics, including International Financial Reporting Standards (IFRS), which are increasingly relevant as more Indian companies adopt global accounting standards. ACCA also includes modules on management accounting, financial management, and corporate governance, offering a broader curriculum.

CA: Heavily focused on Indian accounting and taxation laws. While it provides comprehensive training in auditing and taxation, the scope is more region-specific compared to ACCA.

Flexibility and Exam Structure:

ACCA: Offers greater flexibility, allowing students to take exams four times a year. ACCA also offers the option to sit for individual exams at a time, which makes it easier for students to balance work and studies.

CA: The CA exam structure is more rigid, with three levels (Foundation, Intermediate, Final) that must be completed sequentially. Students can only sit for exams twice a year, and the pass rates tend to be lower, making the process more competitive and time-consuming.

Duration and Pass Rates:

ACCA: Can typically be completed in 2-3 years, depending on the student’s pace. The pass rates for ACCA exams are generally higher compared to CA.

CA: It can take anywhere between 3-5 years to complete the CA qualification, with a significantly lower pass rate, particularly at the CA Final level.

For an in-depth comparison of ACCA and CA, explore our comprehensive guide: ACCA vs CA.

ACCA vs CFA

The CFA program, offered by the CFA Institute, is a highly respected qualification in investment management, popular for careers in investment banking, portfolio management, and equity research. While both ACCA and CFA are globally recognized, they focus on different sectors of finance.

Scope and Focus:

ACCA: Primarily focuses on accounting, auditing, financial management, taxation, and business strategy. It offers a broader scope, preparing professionals for a wide range of finance roles.

CFA: Specializes in investment management, equity research, financial analysis, and portfolio management. The CFA curriculum covers topics like asset valuation, financial reporting, economics, and ethics, making it ideal for those focused on investment finance.

Career Opportunities:

ACCA: Graduates often work in roles such as financial controllers, management accountants, and tax consultants. ACCA provides flexibility in working in various finance roles across industries, including consulting, taxation, banking, and corporate finance.

CFA: The CFA designation is tailored for professionals in investment roles, including investment bankers, portfolio managers, analysts, and traders. It is widely recognized in the asset management industry.

Flexibility and Exams:

ACCA: Offers four exam sessions a year, with the ability to take exams individually. It provides more flexibility for students in terms of study schedule and exam attempts.

CFA: The CFA exam consists of three levels (Level I, II, and III), with exams offered twice a year for Levels I and II, and once a year for Level III. The pass rates are quite low, particularly for the advanced levels, making the CFA one of the more challenging financial qualifications.

Study Duration:

ACCA: Can be completed in approximately 2-3 years, depending on the individual’s progress and pace.

CFA: The CFA program typically takes 3-4 years to complete, as candidates need to pass all three levels of exams, and many find it necessary to reattempt at least one level due to the difficulty.

For an in-depth comparison of ACCA and CFA, explore our comprehensive guide: ACCA vs CFA.

ACCA vs CIMA

CIMA is another globally recognized qualification, primarily focused on management accounting. It is often compared to ACCA because both qualifications have overlapping areas, but they cater to different types of accounting careers.

Career Focus:

ACCA: Provides a broad spectrum of knowledge that prepares professionals for various roles in financial accounting, taxation, and business strategy. ACCA professionals are often employed in auditing firms, financial services, and consulting roles.

CIMA: Specializes in management accounting and strategic financial management, making it ideal for professionals who aim to work as management accountants, financial controllers, or business analysts.

Recognition and Scope:

ACCA: Recognized in over 170 countries, ACCA is valued for its emphasis on auditing, taxation, and financial reporting, making it suitable for those looking for diverse roles in finance.

CIMA: While CIMA is also globally recognized, it is primarily geared toward management accountants and professionals who want to focus on performance management and cost accounting within corporations.

Exam and Syllabus Structure:

ACCA: ACCA exams cover a broad range of topics, including financial reporting, taxation, management accounting, and audit. The exams are held four times a year, offering greater flexibility for students.

CIMA: CIMA exams are based on case studies that require candidates to apply management accounting principles to real-world business scenarios. CIMA also focuses heavily on strategic decision-making and business performance. Exams are held four times a year but involve more strategic applications.

Duration:

ACCA: Typically takes 2-3 years to complete.

CIMA: Can take between 3-4 years depending on the student’s progress through the various levels of CIMA exams.

For an in-depth comparison of ACCA and CIMA, explore our comprehensive guide: ACCA vs CIMA.

Conclusion

Working for an ACCA Approved Employer can be a game-changer in your professional journey, whether you’re an ACCA student, affiliate, or member. These employers offer the structured support, training, and mentorship necessary to meet ACCA’s rigorous requirements and fast-track your career. By aligning with an ACCA Approved Employer, you gain access to a supportive environment that not only helps you complete your qualification efficiently but also provides ongoing opportunities for professional growth and global recognition.

From utilizing the ACCA Employer Directory to attending career fairs and leveraging your professional network, there are many effective ways to find an ACCA Approved Employer. By choosing the right employer, you can set the foundation for long-term success in the finance and accounting industry, ensuring you have the resources and guidance to thrive in your career.

Frequently Asked Questions

An ACCA Approved Employer is a company recognized by ACCA for its commitment to supporting the development of ACCA students and members.

You can check the ACCA Employer Directory on the ACCA website to verify if a company is approved.

Benefits include exemptions from performance objectives, structured learning, CPD support, and global recognition.

Yes, any business that meets ACCA’s stringent criteria for training and development can apply to become an approved employer.