Make a choice of success!

FRM Online Classes

- FRM coaching classes with 92% Success Rate

- 200 + Hours of HD Video Content with Detail notes

- Detailed Audio Notes for all Chapters in FRM Part 1

- Live Doubt Sessions and Active Discussion Forum

- Sectional Practice Test and Full Length Mocks

- Video solutions of FRM Institute's Official Material questions

- Quintedge's AI Based Real-Time FRM Doubts Solver

Get a Call - Back

Program Highlights of FRM Online Coaching

Here are a few features of our coaching which will help you breeze through FRM exam preparation.

200+ Hours Videos

Revision & Backup Classes

Relevant Industry Updates

What Makes Us The Best CFA Online Coaching?

Below are a few key points that make us a preferred choice amongst students for online FRM Coaching.

Highly Credible Trainers

Our trainers are FRMs themselves and have experience in Risk Management, Credit Risk Modeling and Portfolio Risk.

Application Based Learning

We have designed training session in such a way that there is ZERO rote learning or mugging of formulae.

Exhaustive Preparation

We’ll deliver 100% practice questions in the Live class itself and Live revision classes a month before exam

High Pass Percentage

Out of the candidates who have taken FRM Coaching through us, roughly 92% managed to clear the exam.

FRM Online Coaching Curriculum

Our curriculum is thorough and highly oriented to the FRM Examination.

How do we cover the syllabus efficiently?

Weightage – 20% (FRM Part 1)

- This module helps us learn how do businesses manage their risks, the tools they use to transfer risks.

- It aims to develop our understanding of various risk and returns models

- The module presents various case studies on risk management from recent financial disasters specifically 2007-2009 crisis.

- Lastly there is a reading on GARP code of conduct

Weightage – 20% (FRM Part 1)

- This module helps you to develop foundation of risk management through basics of statistics

- It covers basic topics like fundamentals of probability, random variable and some advance topics like Hypothesis testing and its application in risk management, Linear & Multiple Regression, Stationery and non-stationery time series analysis etc.

- Focus of this module is to develop in depth understanding of various types of distributions like Normal, Log normal, chi-squared, beta and their uses in risk management

Weightage – 20% (FRM Part 1)

- The first part of this section focuses informing candidates about banks/ Insurance companies & funds and second part focuses of derivative instruments.

- Derivatives part of this section cover topics like Exchanges and OTC markets, Central clearing, Pricing Forex, futures and option instruments, various options trading strategies, exotic options, Swaps etc.

Weightage – 30% (FRM Part 1)

- Measures of financial risk – Value at risk (VaR) and its application into risk Management.

- Measuring and estimating volatility (GARCH model).

- Measuring credit risk: – Vasicek model, Creditmetrics, Gaussian copula model

- Fixed Income security: – Interest rates, Duration, convexity, parallel and non-parallel. structure shifts and hedging.

- Options pricing: – Binomial tree, Black-Scholes Merton, Option Greeks.

Weightage – 20% (FRM Part 2)

- Risk measures: Parametric non parametric estimation of Var, Extreme value theory (EVT), Back testing VaR, Estimated shortfall.

- Term structure models of Interest rates (Shape, drift, volatility & distribution).

- Correlation and its behaviour on real world.

- Volatility smiles & term structure.

Weightage – 20% (FRM Part 2)

- For banks and financial institutions, liquidity is one of the most essential resources. This module discusses the sources and uses of liquidity, ways using which banks can manage liquidity, Cash flow modelling, cross-currency funding etc.

- Other part of module focuses on banks’ Balance sheet management

Weightage – 20% (FRM Part 2)

- This module majorly discusses small-small aspects of operational risk and how and enterprises can develop resilience against those operational risk.

- The other part of this module discusses evolution of Basel norms over years.

- Barring few handful chapters, most on the chapters are text heavy.

Weightage – 15% (FRM Part 2)

- This module covers topics like Factor theory, Optimal Portfolio construction given investment constraints, portfolio risk management and measurement, risk monitoring and performance measurement, risk budgeting and hedge funds.

- Module is formula heavy and involves lots of calculations.

Weightage – 10% (FRM Part 2)

- This module focuses on current issues that have strong impact on financial markets like use of AI and ML uses in financial markets, threats of cyber-attacks on financial systems, transition from reference rate regime to overnight risk free rate, Covid-19 impact on markets, disasters due to climate changes and its impacts on financial institutions.

Weightage – 20% (FRM Part 2)

- This module focuses on developing understanding credit risks of banks.

- One part of this module focuses capital structure of banks, how credit ratings are assigned, portfolio credit risk, credits spreads and spread risks and credit risk management using Credit Var.

- Second part of this module focuses Counter party risk management, Credit value adjustment (CVA), stress testing of counter party risk, retail credit risk and credit scoring.

- Third part of this module focuses credit risk transfer mechanism like securitization and credit derivatives.

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge

Where we go the extra mile in FRM prep unlike any other

Offering

Others

24/7 Peer and Tutor Forums for immediate query resolution

Exclusive industry insights with current market trends

Continuous course updates, ensuring current content relevancy

Pass Assurance for FRM Prep Course Students

Full Length Mock FRM Tests with ‘Near’ Exam Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier finance professionals

Scholarship & Registration Guidance for FRM Students

Dedicated FRM Exam Faculty for last-minute doubt solving

Dedicated post-exam debrief sessions and improvement strategies

Discover The Seamless Learning Experience

Features of Our FRM Online Coaching Platform

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

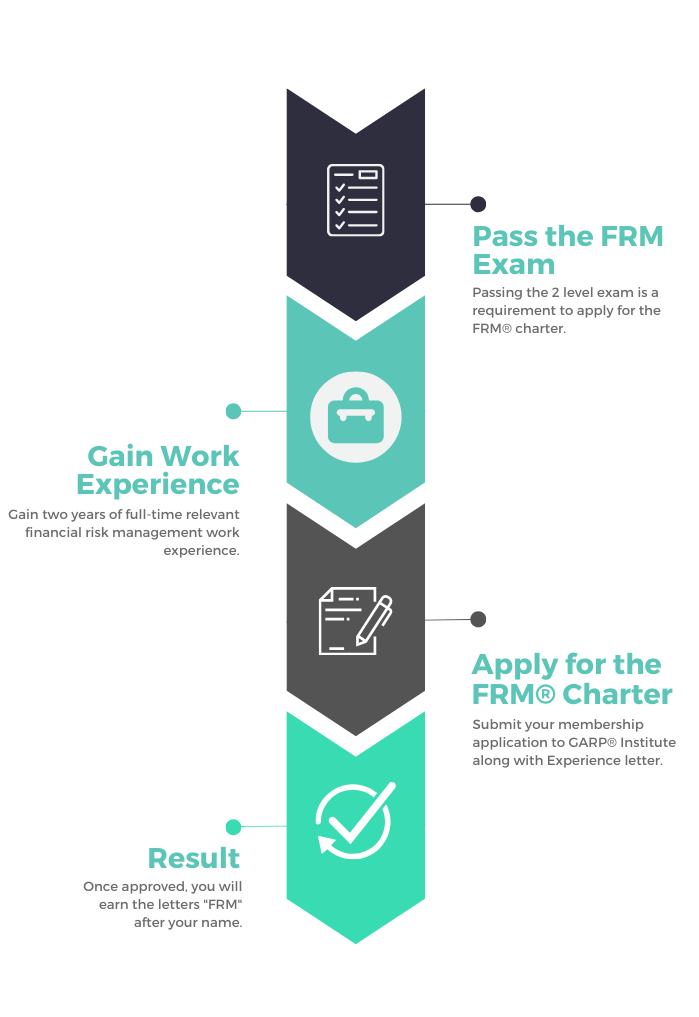

Know Your Timeline

How to become an FRM Holder?

Charting Your Path to FRM Success: A Step-by-Step Journey with Quintedge

Faculty for Our FRM Online Coaching

Industry Experts

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash Jain

Yash is a seasoned Investment Banking Trainer and Ex – Senior Associate at Bain & Co. specializing in Corporate Finance. He has trained over 5000 candidates till date and is renowned for his engaging sessions at prestigious institutions like IIT, Goldman Sachs, and NIFM.

Sudhanshu kanwar

Sudhanshu is a Global Markets Strategist, with a storied career at Goldman Sachs. His credentials, including CQF, FRM, and CFA, reflect his deep analytical acumen. As a member for the Harvard Review, he combines expertise with a passion for mentorship.

Sandesh Banger

Mr. Sandesh is an accomplished finance professional with 15 years of diverse experience across banking & finance. His real-world insights and practical knowledge equip students with the skills needed to excel in the field of risk management

Ankita Agarwal

Ankita is a distinguished finance professional with a strong background in investment strategy and management. Having held significant positions at top-tier firms, she’s a CFA Charter holder. She is known for her interactive and insightful teaching approach.

WHAT WE ACHIEVED

Our Awesome Past Records

Over the years, our students’ satisfaction and the success rate are worth an eyeball.

0 +

Batches Taken

0

Countries

0 %

Pass Rate

0 +

FRM Students

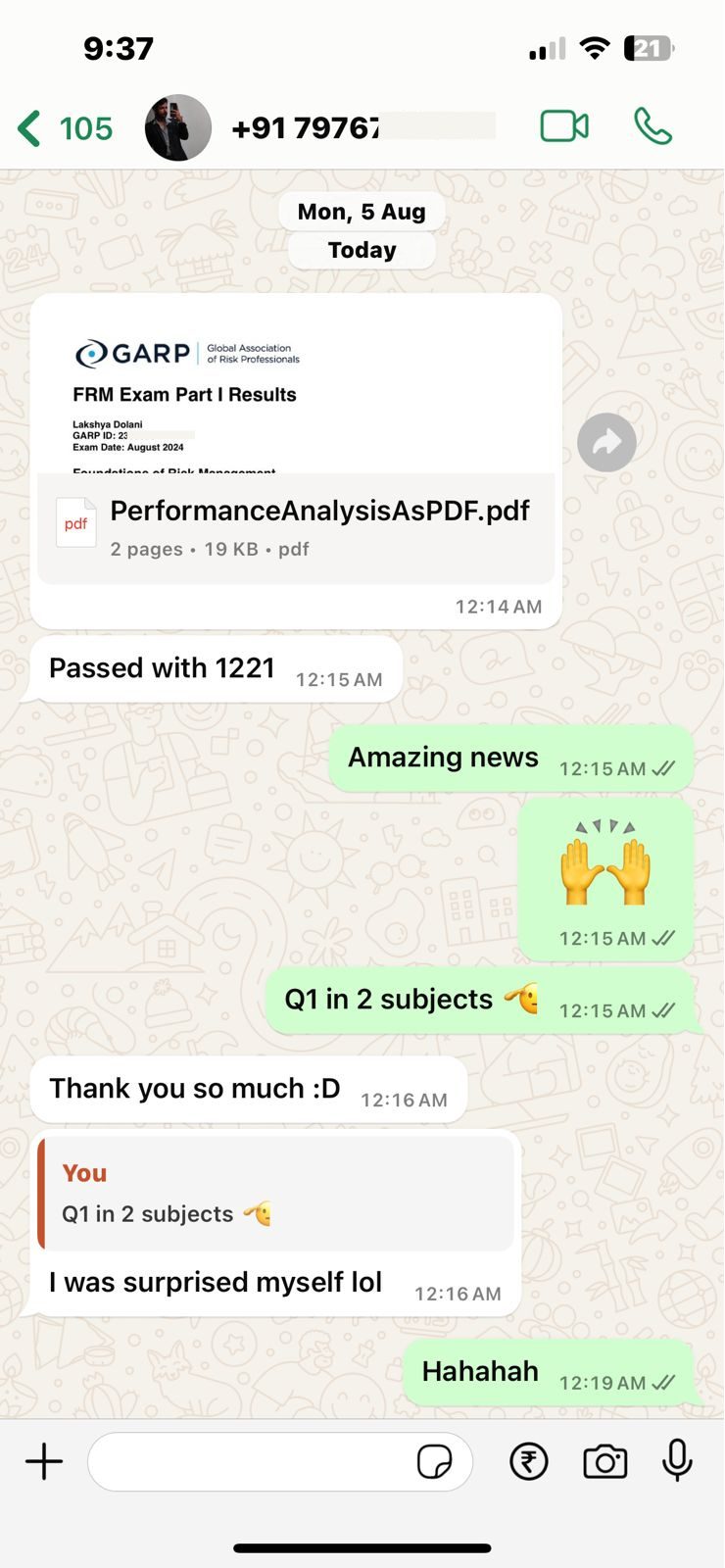

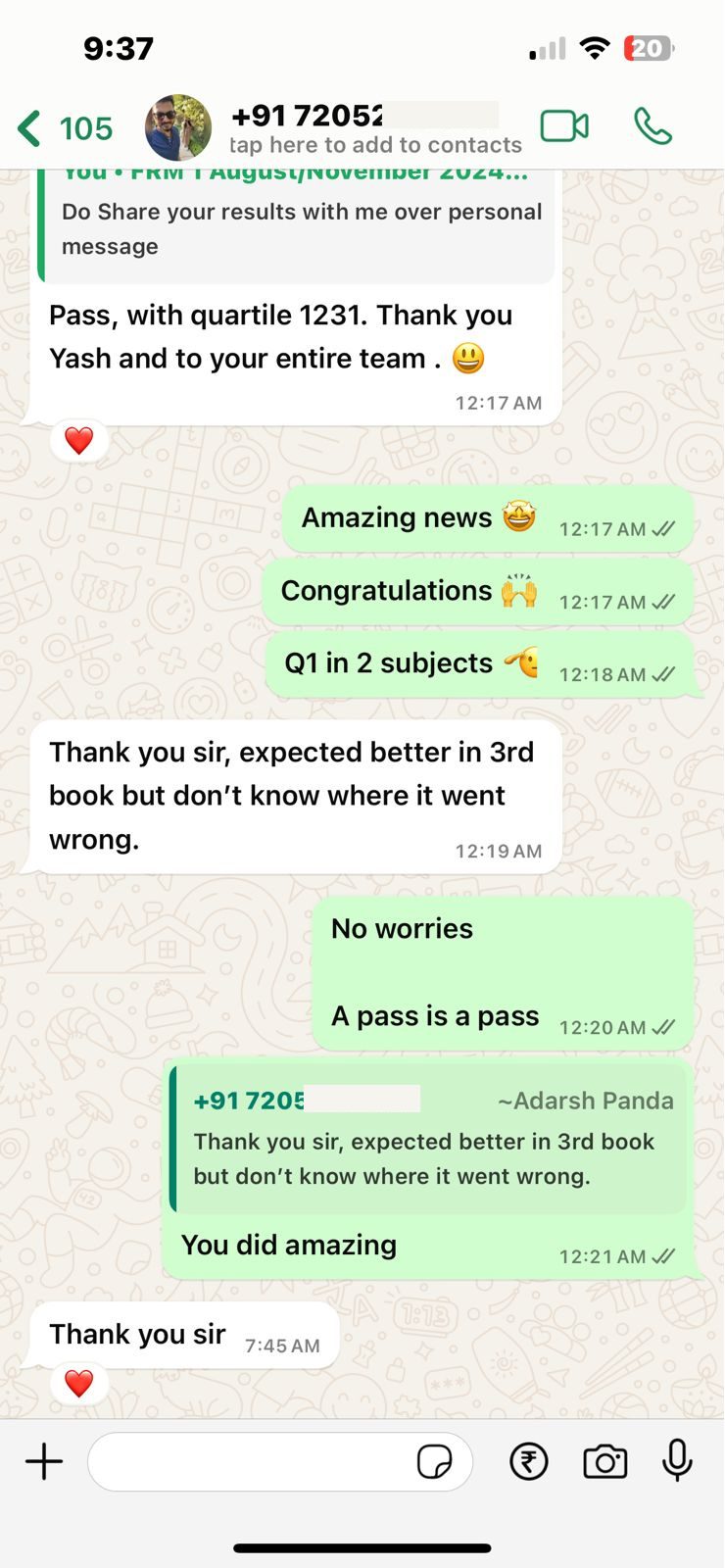

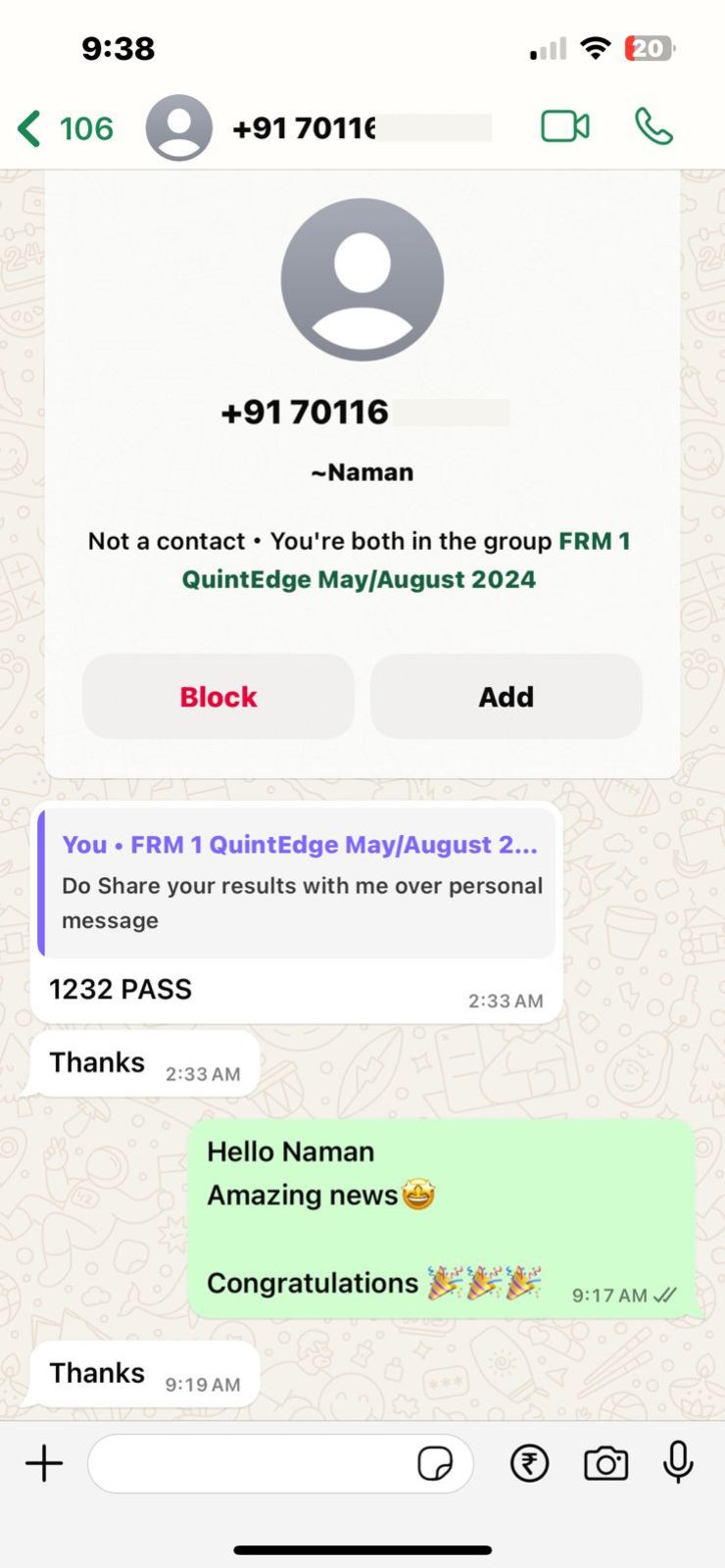

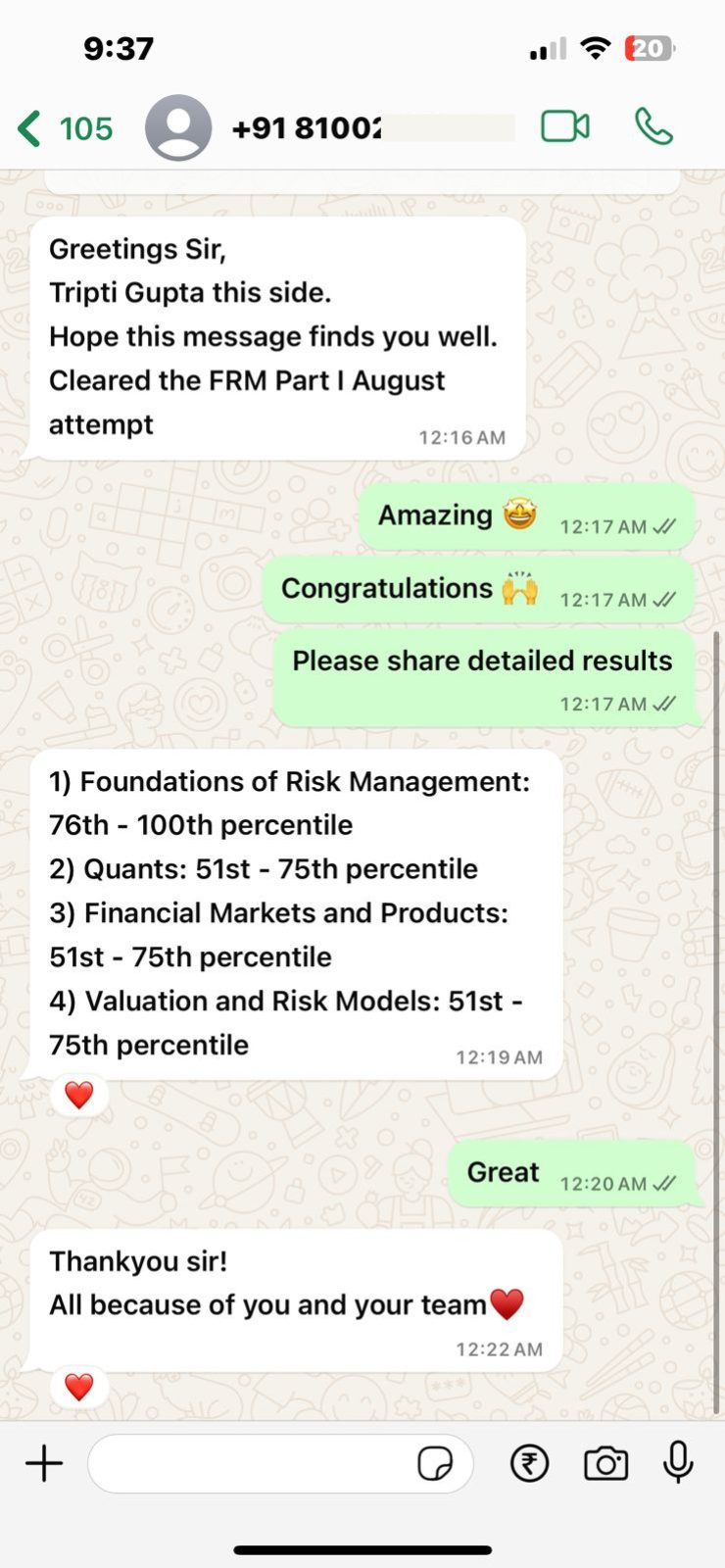

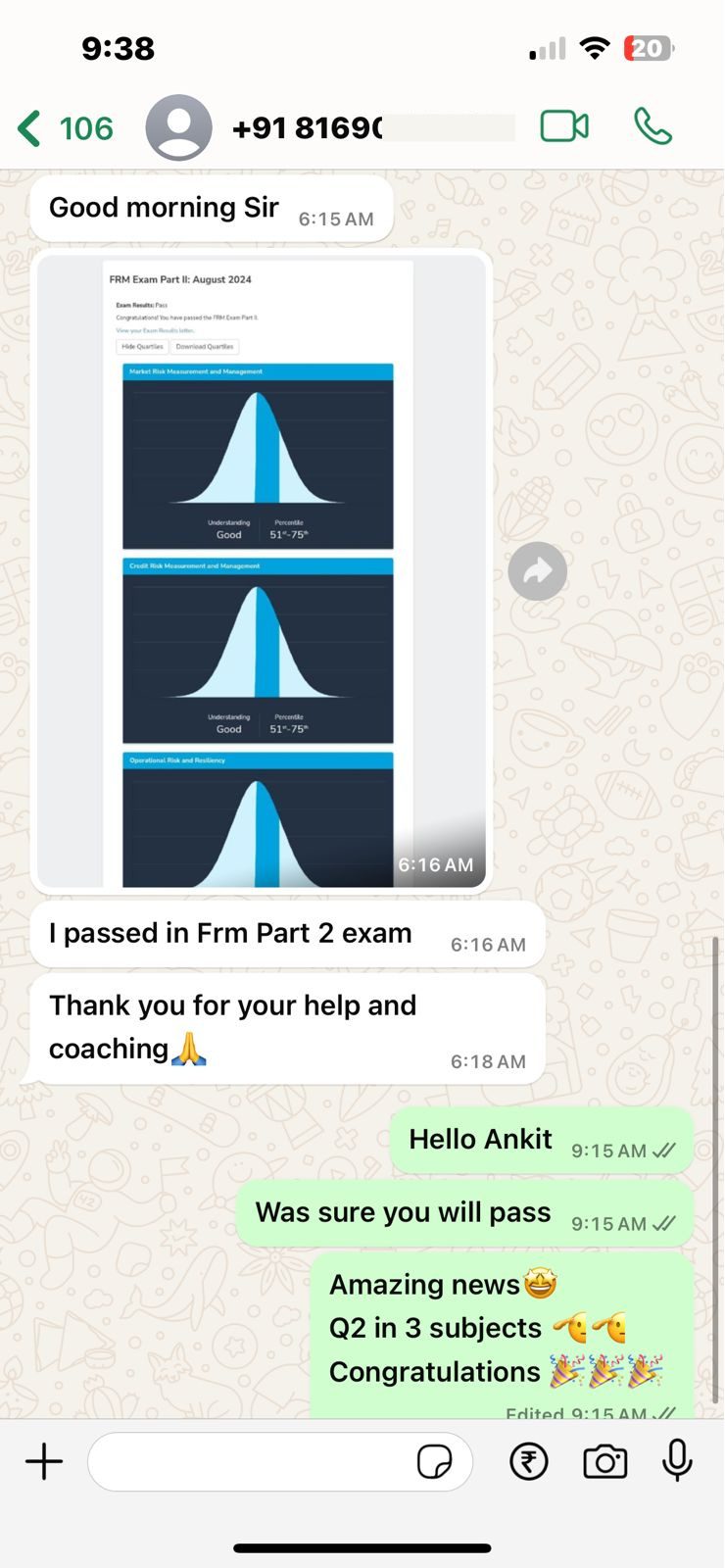

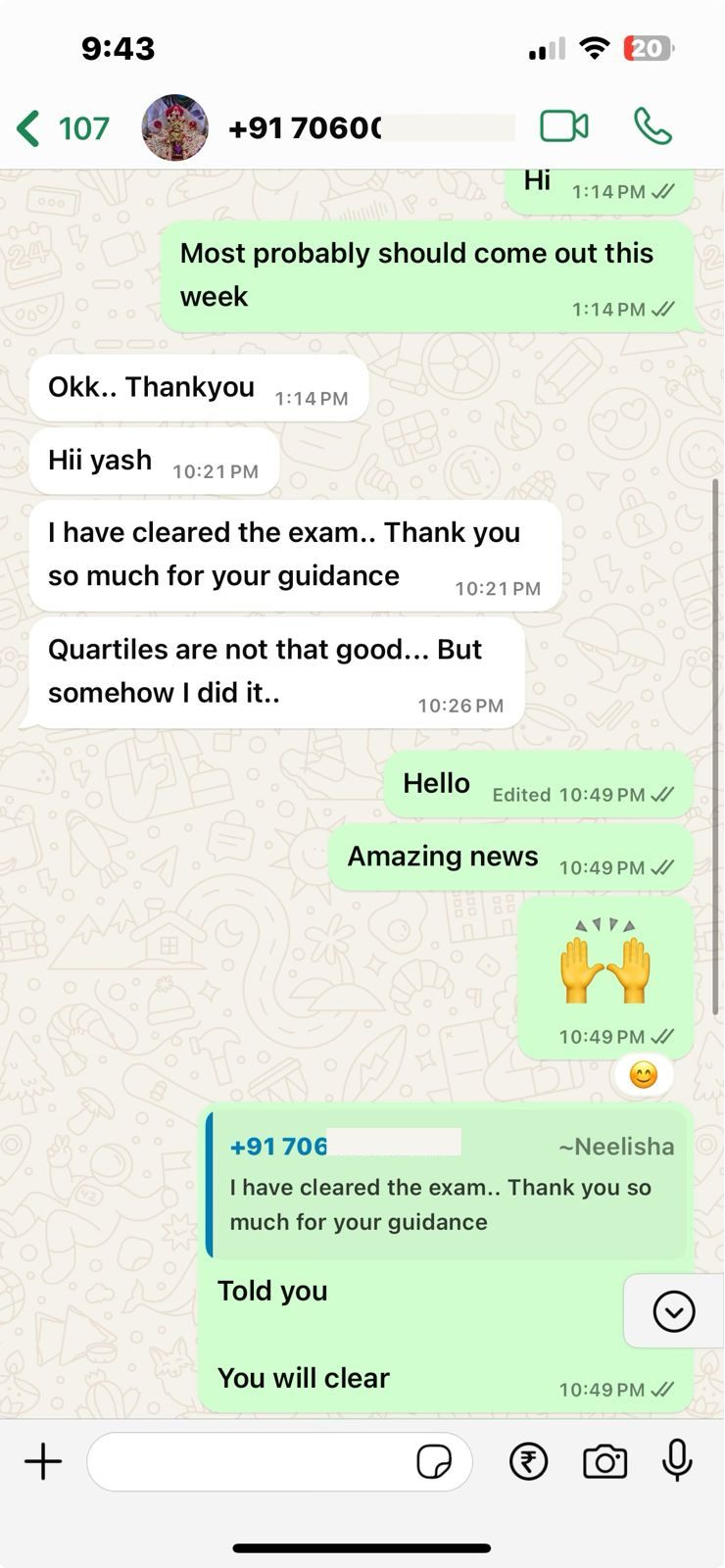

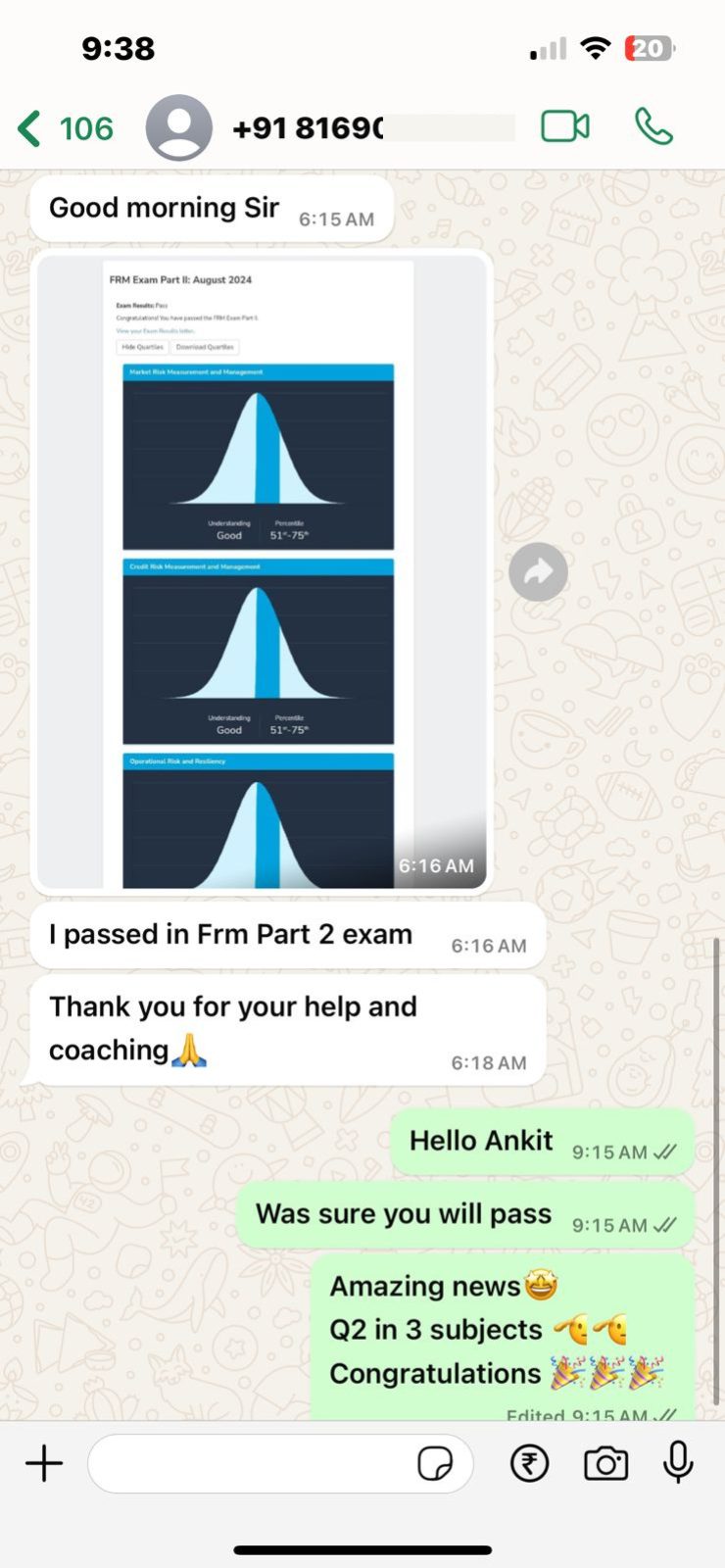

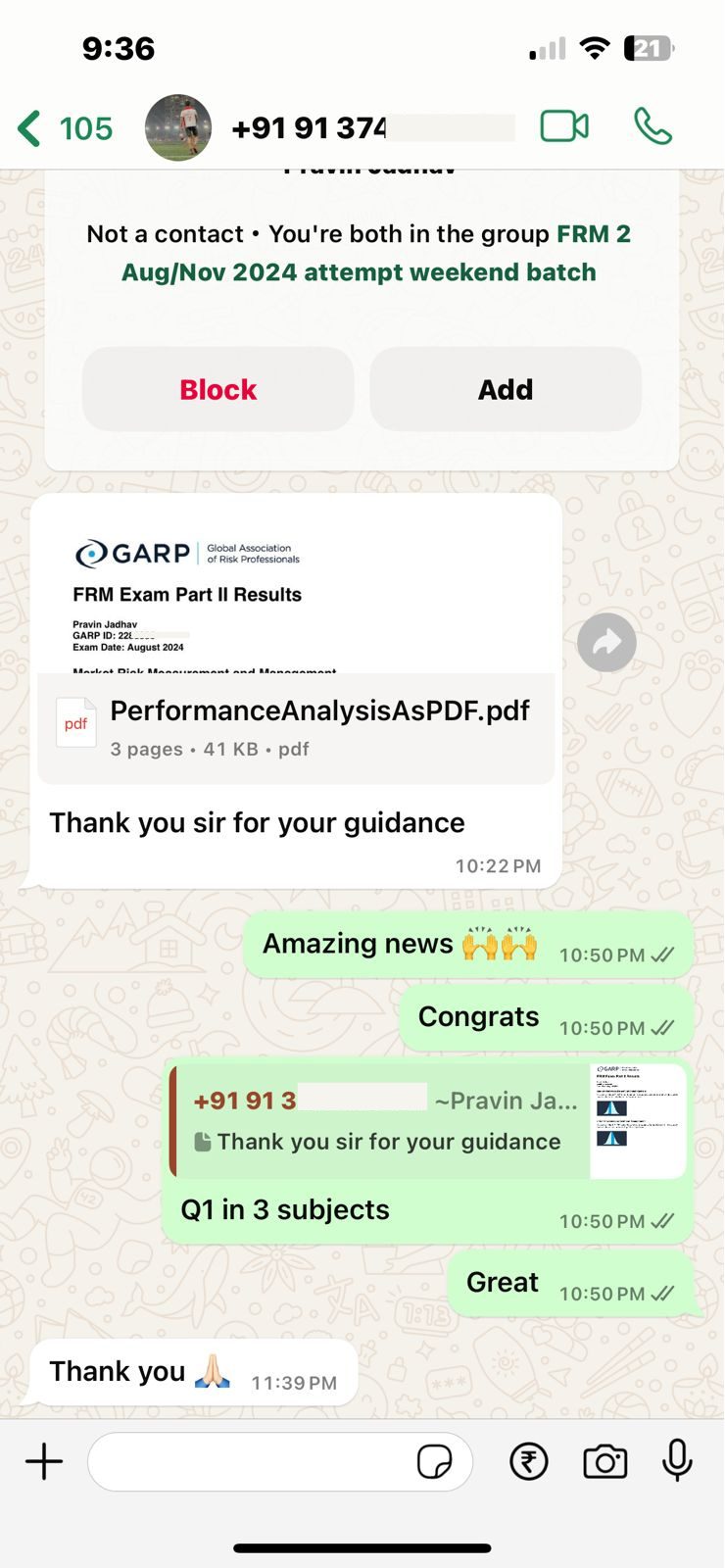

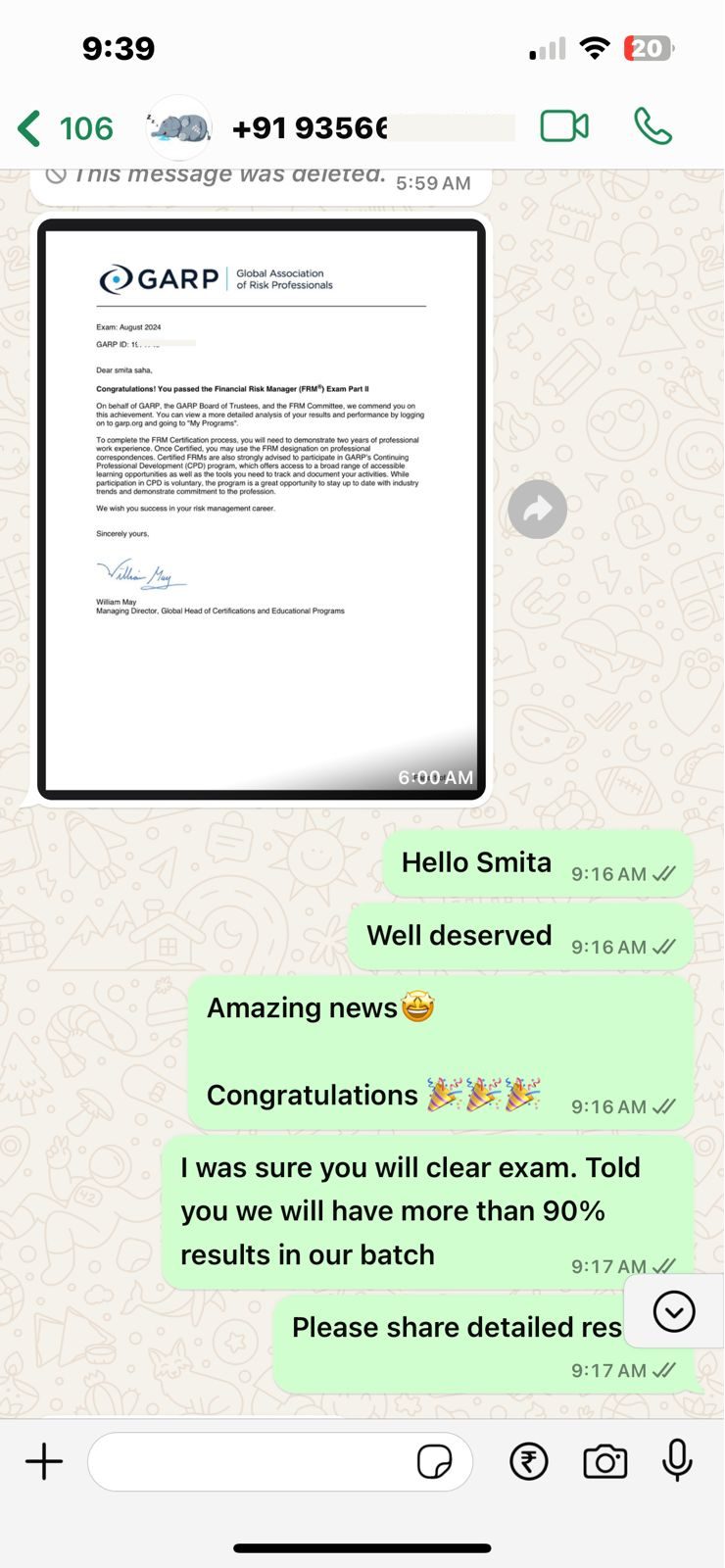

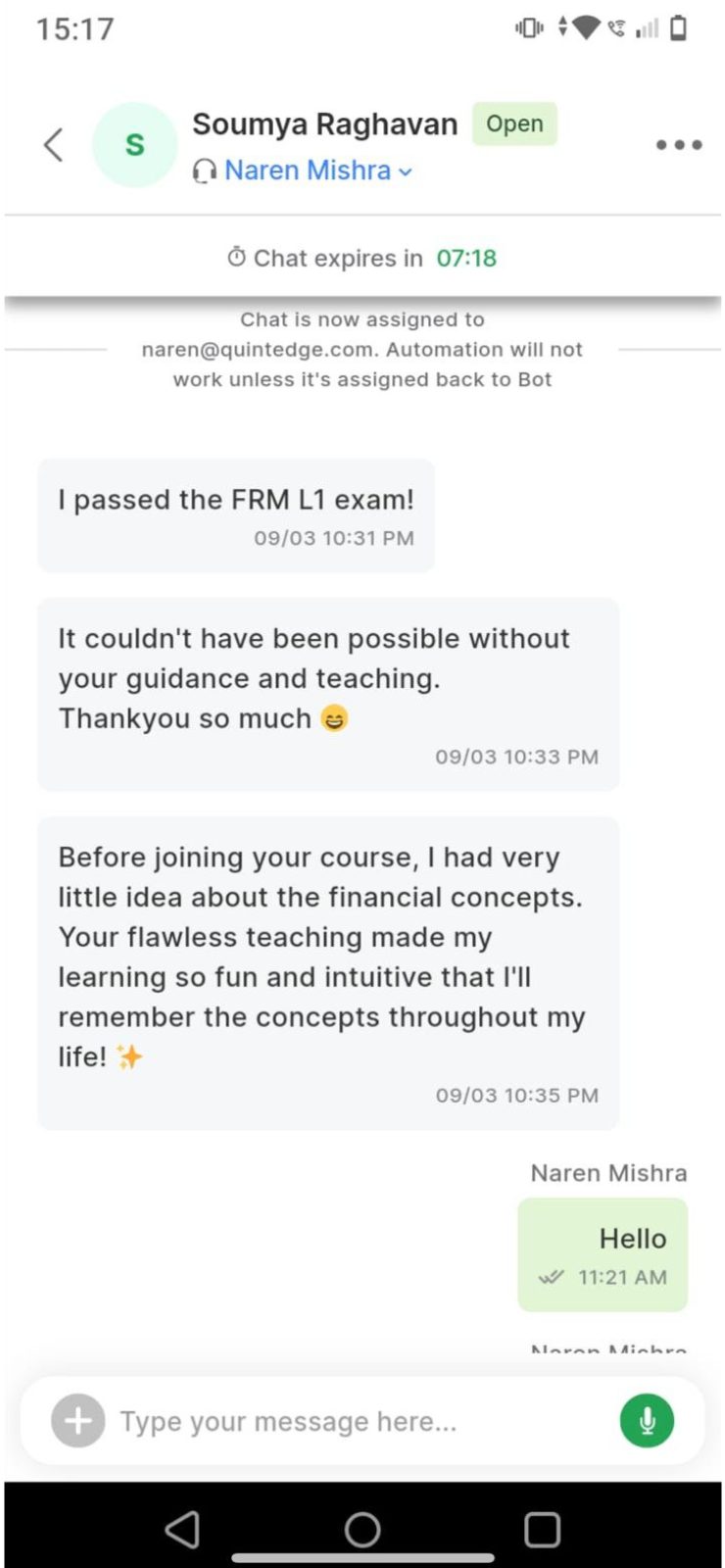

FRM Online Coaching Testimonials

From the Past Candidates

Read on to know what our students have to say

FRM Scope, Salaries & Opportunities

Let’s get to know how this qualification can shape your future and career.

Recognition

FRM is recognised as the most comprehensive course on risk management and thus well respected in Finance fraternity.

Job Profiles

FRM Charter holder works in domain like portfolio management, credit risk modelling, research, consultancy, etc.

Median Salary

Initial median salary of FRM charter in Indian is between Rs. 8.00 Lakhs to Rs. 12.00 Lakhs per annum

Fees & Variations of FRM Online Coaching

FRM Part I

₹ 25,000 Onwards

- Self Paced FRM Part - I Classes with Unlimited Doubt Solving, Interactive Videos, and 100% Question Coverage

FRM Part II

₹ 27,000 Onwards

- Self Paced FRM Part - II Classes with Unlimited Doubt Solving, Interactive Videos, and 100% Question Coverage

FRM Part I

Live Online Classes

₹ 31,000

- Live FRM Part - I Classes with Unlimited Doubt Solving, Interactive webinars, and 100% Question Coverage

FRM Part I

Offline / Hybrid Classes

₹ 35,000

- Live FRM Part - I Classes with Unlimited Doubt Solving, Interactive classes, and 100% Question Coverage

FRM Part II

Live Online Classes

₹ 34,000

- Live FRM Part - II Classes with Unlimited Doubt Solving, Interactive webinars, and 100% Question Coverage

Have Doubts?

Know More About FRM Exam

Unlock insights into the Financial Risk Manager® designation – the gold standard in Risk Management

Ace Risk Management with QuintEdge's FRM Coaching Classes Online

Financial Risk Manager is the accreditation provided by the reputable Global Association of Risk Professionals (GARP). FRM serves in 200+ countries and has about 280,000 professionals as members.

The FRM course follows a thorough curriculum that covers a wide range of topics, including quantitative analysis, market risk, credit risk, operational risk, and regulatory compliance. Candidates are put through a two-part examination procedure that tests their abilities to examine, appraise, and reduce financial risks.

The dynamic financial world is filled with uncertainty and risks await at every turn. With numerous complexities a thorough understanding of how to manage risks is crucial. Amidst this landscape, the Financial Risk Manager (FRM) course stands out as an oasis of knowledge, providing a structured path for anyone looking to understand the complexity of risk. The educational experience provided by QuintEdge FRM coaching classes Online will equip you with a thorough financial understanding enabling you to excel in risk management.

Why you should pursue FRM Online Course?

The reason for choosing the FRM course online is that there are so many pros as compared to the classroom which maybe it couldn’t provide. First, online classes allow you to study without difficult schedules and sitting sessions. The flexibility truly stands out for those who are working professionals or studying and have a busy schedule. Moreover, online courses replicate the vast array of resources utilized in the classroom, such as mini-courses with videos, quizzes, and discussion forums, which contribute to the learning environment. Also, online courses wipe out the necessity of commuting to the physical classrooms which is a substantial advantage in slippery budgets and the poor economy of our country.

FRM Online Course Eligibility

There are no special requirements regarding your prior education, age, or other criteria to take the FRM Exams. However, certain prerequisites must be satisfied to obtain the final certification:

- You must complete both levels 1 and 2 of the FRM Programme within four years of enrolling for the Part 1 exam.

- You must have at least two years of work experience that is related to risk management profile, acquired within five years of finishing Part 2 of the exam.

Candidates aiming to pursue FRM usually take up FRM classes to assist them prepare for their exams. QuintEdge is one the best FRM coaching institutes in India that provides you with tailored and extensive online FRM coaching. If you are looking to pursue a FRM course in India then QuintEdge is the best institute to learn from.

Why Choose QuintEdge for FRM Coaching Class Online?

Concerning enrolling in the FRM online course, there are a couple of justifications why our one is a unique choice. Above all, the course curriculum by a team of industry professionals discusses the most recent topics and trends in risk management. You will have hands-on experience as well as theoretical knowledge that you can deploy onto on-the-ground tasks.

Furthermore, QuintEdge is designed to be intuitive and simple while facilitating access to study materials. Additionally, it is worth noting that our trainers are experienced practitioners in risk management who share with participants the required knowledge and tools during the course. Conclusively, we provide holistic support to our students including the availability of resource documents, steps assessment, and personal engagement with tutors.

In conclusion, enrolling in an e-based FRM course is a worthwhile option for you as a finance professional who wishes to build a solid and successful career pathway. E-learning provides you with the possibility to choose time for studying, finding resources, and getting some pieces of advice from the experts. So, you will inevitably acquire the essential competencies for risk management. Starting to manage your finance career with QuintEgde by enrolling in our Investment Banking Online Course, CFA Online Course, ACCA Online Classes, take the first step!

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

The Financial Risk Manager (FRM) certification is an internationally recognized credential from the Global Association of Risk Professionals (GARP). It is designed for professionals aiming to excel in risk management, covering market risk, credit risk, operational risk, and investment management. Earning this certification showcases your expertise and commitment to managing financial risks.

Our FRM course is perfect for finance and banking professionals, risk management practitioners, and anyone keen on mastering risk management. It’s also ideal for those looking to boost their career prospects and credentials in the financial industry.

The FRM exam is split into two parts. Part I covers the basics of risk management, including quantitative analysis, core concepts, and financial markets and products. Part II goes deeper, focusing on applying these tools to market risk, credit risk, operational risk, and investment risk management. Both parts feature multiple-choice questions designed to test your knowledge and analytical skills.

To register for our Live Coaching, you can call up our counsellors and they will guide you with the registration process.

There will be 35 classes of 3 hours each in the Live course, amounting to roughly 105 hours of training.

With an FRM certification, you’ll be ready to take on advanced roles in risk management at banks, investment firms, corporate finance, and consulting firms. Plus, our career services team is here to help you make the most of your new qualifications and reach your career goals.

There is no specific eligibility. However, we recommend you to complete High School before enrolling for FRM Coaching.

After you become an FRM Charterholder, you can get into profiles such as Risk Modeling, Credit Risk, Portfolio Management etc.

Absolutely! If you don’t pass the FRM exams on your first try, you can retake them as many times as needed. Plus, our Quintedge team offers extra support and resources to help you prepare for your next attempt.

Our instructors are seasoned professionals with extensive experience in finance and risk management. They hold advanced degrees in finance, economics, or related fields, and have relevant certifications like FRM, CFA, and PhDs. Their industry experience and practical knowledge ensure you receive a high-quality learning experience.

Quintedge offers a complete set of study materials to cover the entire FRM exam syllabus. This includes detailed textbooks, practice questions, summary sheets, and mock exams. Our interactive online platform also provides video lectures, webinars, and a digital library, giving you a variety of tools to enhance your learning and preparation.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.