What is ACCA?

The Association of Chartered Certified Accountants (ACCA) is a prestigious platform for those aiming to become adept money managers. It’s a global passport to a career in finance, recognised from New York to Switzerland.

ACCA doesn’t just arm you with textbook knowledge; it prepares you to deal with the financial heartbeat of a company, ensuring it is healthy and thriving.

Whether it’s budgeting wisely, or strategising for financial growth, ACCA equips you with the skills to do it all. The flexibility it offers allows you to tailor your learning journey.

And it’s not just about individual growth; it’s about joining a global network of financial wizards, constantly learning and evolving.

ACCA Course Overview & Eligibility

Overview of ACCA Course

The ACCA course is meticulously designed to provide a blend of theoretical knowledge and practical skills. It’s structured in a way to build a strong foundation in accounting and finance, followed by a deeper dive into advanced topics as you progress through the levels.

The journey through ACCA is like climbing a ladder, where each rung equips you with more tools and knowledge to excel in the financial world.

ACCA Eligibility Requirements

The eligibility requirements for registering for the ACCA (Association of Chartered Certified Accountants) course in India are fairly inclusive, allowing a wide range of students and professionals to pursue the qualification.

The basic ACCA qualification requirements are:

- Minimum Age: There is generally no minimum age to start the ACCA qualification, but you need to be 18 or older to register yourself without a parent or guardian.

- Educational Qualifications:

- For students who have completed their 10+2 (higher secondary education), ACCA requires a minimum of five separate subjects including English and Mathematics / Accounts, with marks of 65% in at least two subjects and over 50% in the others.

- Students who have not met these marks may begin their studies with ACCA’s Foundation-level qualifications, which provide a pathway into the ACCA qualification.

- Graduates and Professionals:

- Graduates from accredited institutions may be exempted from some exams depending on their degree subject and the university they graduated from.

ACCA Subjects & Total Paper

The journey through ACCA exams is akin to a rigorous training camp that moulds you into a financial expert. Each exam is structured to test your understanding and the ability to apply your knowledge in real-world scenarios –

Exams in Applied Knowledge Level:

- Business and Technology (BT)

- Management Accounting (MA),

- Financial Accounting (FA)

These exams lay the foundation, testing your understanding of basic financial and business principles.

Exams in Applied Skills Level:

- Corporate and Business Law (LW),

- Performance Management (PM),

- Taxation (TX),

- Financial Reporting (FR),

- Audit and Assurance (AA),

- Financial Management (FM)

These exams are more complex, requiring a deeper understanding and the ability to analyse and interpret information.

Exams in Strategic Professional Level:

- Strategic Business Leader (SBL),

- Strategic Business Reporting (SBR)

and two of the four Optional papers –

- Advanced Financial Management (AFM),

- Advanced Performance Management (APM),

- Advanced Taxation (ATX),

- Advanced Audit and Assurance (AAA)

These are the most advanced exams, requiring strategic thinking and professional judgment.

These are the 13 paper you need to clear to become an ACCA graduate. However, you may get exemptions based on your previous qualifications. The number of exemptions you get is based on the field, institutions and your qualifications.

Check out the ACCA Exemption calculator

ACCA Exam Pattern, Duration & Schedule

Exam Schedule

The examination schedule in ACCA is quite flexible, allowing students to plan their exams around their personal and professional commitments. Exams are held four times a year – in March, June, September, and December.

When to book the ACCA Exams?

You can book your exams well in advance, typically up to 14 weeks before the exam date, enabling you to plan your study schedule accordingly.

Pattern & Duration of ACCA Exams

The examination process in ACCA is thorough and challenging, and most of the exams are conducted through Computer-Based Exams (CBEs), ensuring a fair and efficient assessment-

- Session CBEs: These are for Applied Skills and Strategic Professional level exams, scheduled during specific times of the year – March, June, September and December.

- On-Demand CBEs: These can be taken anytime during the year and are usually for Applied Knowledge and some Applied Skills level exams.

The question formats range from multiple-choice questions (MCQs) to long-form answers, as given in the table below. –

| Subject | Exam Duration | Exam Pattern |

| Business and Technology (BT) | 2 Hrs On-Demand CBE | This paper is divided into two sections. Section A consists of 35 objective type questions of 2 marks each. Section B contains three multi-task questions of 10 marks each. |

| Management Accounting (MA) | 2 Hrs On-Demand CBE | This paper is divided into two sections. Section A consists of 35 objective type questions of 2 marks each. Section B contains three multi-task questions of 10 marks each. |

| Financial Accounting (FA) | 2 Hrs On-Demand CBE | This paper is again divided into two sections. Section A consists of 35 objective questions of 2 marks each, and Section B consists of 2 questions of 15 marks each. |

| Corporate and Business Law (LW) | 2 Hrs On-Demand CBE | This paper is divided into two sections. Section A consists of 25 objective type questions of 2 marks each and 20 questions of 1 mark each. Section B contains five multi-task questions of 6 marks each. |

| Performance Management (PM) | 3 Hrs Session CBE | This paper is again divided into two sections. Section A consists of 30 objective questions of 2 marks each, and Section B consists of 2 constructed-response workspace questions of 20 marks each. |

| Taxation (TX) | 3 Hrs Session CBE | This paper is again divided into two sections. Section A consists of 30 objective questions of 2 marks each, and Section B consists of 2 constructed-response workspace questions of 20 marks each. |

| Financial Reporting (FR) | 3 Hrs Session CBE | This paper is again divided into two sections. Section A consists of 30 objective questions of 2 marks each, and Section B consists of 2 constructed-response workspace questions of 20 marks each. |

| Audit and Assurance (AA) | 3 Hrs Session CBE | This paper is divided into two sections. Section A consists of 15 objective questions of 2 marks each, and Section B consists of two 20 marks and one 30 marks constructed response workspace question. |

| Financial Management (FM) | 3 Hrs Session CBE | This paper is divided into two sections. Section A consists of 30 objective questions of 2 marks each, and Section B consists of 2 constructed-response workspace questions of 20 marks each. |

| Advanced Financial Management (Optional) | 3 Hrs Session CBE | It is a subjective paper with only 1 section consisting of two 25 marks questions and one 50 marks question. |

| Advanced Performance Management (Optional) | 3 Hrs Session CBE | It is a subjective paper with only 1 section consisting of two 25 marks questions and one 50 marks question. |

| Advanced Taxation (Optional) | 3 Hrs Session CBE | It is a subjective paper with only 1 section consisting of two 25 marks questions and one 50 marks question. |

| Advanced Audit and Taxation (Optional) | 3 Hrs Session CBE | It is a subjective paper with only 1 section consisting of two 25 marks questions and one 50 marks question. |

| Strategic Business Leader (SBL)- Compulsory | 3 Hrs Session CBE | It is a subjective paper with only 1 section comprising one 80 question 20 marks for professional skills. |

| Strategic Business Reporting (SBR)- Compulsory | 3 Hrs Session CBE | It is a subjective paper with only 1 section consisting of two 25 marks questions and one 50 marks question. |

The ACCA exam process is structured to not just test rote memorisation, but to evaluate your understanding, application, and analysis of the financial and business concepts.

Requirements to Become an ACCA

A. Work Experience

ACCA students are required to complete 36 months (three years) of relevant professional experience in finance or accounting roles. This experience is also known as Practical Experience Requirement (PER). This experience can be obtained before, during, or after completion of the ACCA exams.

The required 36 months of experience do not need to be completed consecutively or with the same employer, allowing for breaks in employment or changes in job roles.

To fulfill the ACCA’s Practical Experience Requirement (PER), you need to gain experience in one or more of the following fields:

- Financial Accounting and Reporting

- Management Accounting

- Taxation

- Finance and Financial Management

- Corporate and Business Law

- Performance Management

- Business Analysis

- Governance, Risk, and Control

- Leadership and Management

B. Other Requirements

Apart from passing the ACCA exams and completing the Practical Experience Requirement (PER), you also need to fulfil the following to become an ACCA member and be considered an ACCA graduate:

1. Ethics and Professional Skills Module: The Ethics and Professional Skills Module (EPSM) is an online module that can be completed at any time after you register as a student with ACCA, but you must complete it before you can qualify as an ACCA member.

- It’s designed to support your development and make you more employable by providing practical exposure to real-world professional ethical and business situations.

- The module concludes with an assessment to test your understanding and application of the knowledge you’ve gained.

- Upon successful completion of the module and its assessment, you will receive a completion certificate which you should keep for your records as part of the evidence of your achievement.

2. Continuous Professional Development (CPD): Once you become an ACCA member, there is a requirement to undertake relevant CPD to keep your knowledge and skills up to date and to ensure you remain competent in your role.

3. Membership Application: After you have completed your exams, the ethics module, and PER, you must formally apply for ACCA membership.

4. Membership Fees: You must pay the annual subscription fee to become a member and then continue to pay each year to maintain your membership.

ACCA Fees Structure

The ACCA fee structure includes several components, some of which are related to exams, registration, and exemptions:

ACCA Registration Fee

There’s a one-time registration fee approx. ₹ 8,400

ACCA Annual Subscription Fee

The annual subscription fee is approx. ₹ 11,400, which is required to maintain registration and continue to access ACCA benefits, resources, and services.

Exam Fees

- Applied Knowledge Level – Each exam costs approx. ₹ 9,200.

- Applied Skills Level – The exam costs approx. ₹ 13,700

- Strategic Professional Level – Exam fees for this level range from approx. ₹ 17,400 to ₹ 24,200.

Ethics and Professional Skills Module

This module costs approx. ₹ 7600

Exemption Fees

If you have prior qualifications, you may be eligible for exemptions from certain exams, although an exemption fee is applicable.

- Each Knowledge Exam Exempted: approx. ₹ 8,500

- Each Skill Exam Exempted: approx. ₹ 11,300

ACCA Passing Percentage and Difficulty Level

The passing percentages for ACCA exams fluctuate depending on the paper and the exam session. For instance, in the September 2023 session, the pass rates for different papers were as follows:

Applied Knowledge Level:

- Business and Technology (BT): 86%

- Management Accounting (MA): 64%

- Financial Accounting (FA): 71%

Applied Skills Level:

- Corporate and Business Law(LW): 84%

- Taxation(TX): 54%

- Financial Reporting(FR): 47%

- Performance Management(PM): 40%

- Financial Management(FM): 49%

- Audit and Assurance(AA): 42%

Strategic Professional Level:

- Strategic Business Leader(SBL): 50%

- Strategic Business Reporting(SBR): 50%

Strategic Professional – Options:

- Advanced Audit and Assurance(AAA): 34%

- Advanced Financial Management(AFM): 45%

- Advanced Performance Management(APM): 34%

- Advanced Taxation(ATX): 48%.

The average pass rate for ACCA is around 55%, indicating a moderate level of difficulty. The exams are challenging and require significant investment in time, money, and effort to clear. Some students find the ACCA difficult due to the amount of time and effort required for preparation.

To get a more in-depth analysis of the difficulty level of ACCA, read – Is ACCA Difficult?

ACCA Level-Wise Keypoints

| Level | Exams | Fee (Approx. ₹) | Pass Percentage (Sept 2023) | Eligibility |

| Knowledge Level | – Business and Technology (BT) – Management Accounting (MA) – Financial Accounting (FA) | Registration Fee: ₹8,400 Annual Subscription: ₹11,400 Exam Fee: ₹9,200 Exemption: ₹8,100 to ₹11,520 | – AB: 86% – MA: 64% – FA: 71% | – 10+2 with 65% in Mathematics/Accounts and English, and 50% in other subjects |

| Skills Level | – Corporate and Business Law (LW) – Performance Management (PM) – Taxation (TX) – Financial Reporting (FR) – Audit and Assurance (AA) – Financial Management (FM) | ₹10,600 to ₹11,600 (This is only the exam fee and excludes the annual subscription and exemption fee) | – LW: 84% – PM: 40% – TX: 54% – FR: 47% – AA: 42% – FM: 49% | – Completion of Applied Knowledge Level exams |

| Strategic Professional Level | – Strategic Business Leader (SBL) – Strategic Business Reporting (SBR) And two of the four Optional papers: – Advanced Financial Management (AFM) – Advanced Performance Management (APM) – Advanced Taxation (ATX) – Advanced Audit and Assurance (AAA) | ₹17,400 to ₹23,600 (This is only the exam fee and excludes the annual subscription and exemption fee) | – SBL: 50% – SBR: 50% – AFM: 45% – APM: 34% – ATX: 48% – AAA: 34% | – Completion of Applied Skills Level exams |

Career Opportunities & Jobs After ACCA

The Association of Chartered Certified Accountants (ACCA) qualification opens doors to a myriad of career opportunities across various sectors and industries. Here are some insights:

ACCA qualified professionals are in high demand across all sectors, ranging from automotive to cosmetics, hospitality, healthcare, retail, and many more. Their expertise in financial management and performance analysis makes them invaluable assets to businesses in any industry.

Job Roles

Some common job roles for ACCA qualified professionals include:

- Financial Accountant – A Financial Accountant is responsible for recording, summarising, and reporting the financial transactions of a company to provide an accurate picture of its financial position.

- Management Accountant – A Management Accountant aids in decision-making by analysing financial information to guide the strategic planning and management of business operations.

- Tax Advisor – A Tax Advisor specialises in providing advice on tax law and compliance, helping individuals and companies minimise their tax liabilities while adhering to tax legislation.

- Financial Analyst – A Financial Analyst evaluates businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability for investment.

- Finance Manager – A Finance Manager oversees the financial health of an organisation by developing strategies, conducting analysis, and ensuring effective management of financial operations.

- Corporate Finance Advisor – A Corporate Finance Advisor offers strategic advice on financial matters such as mergers and acquisitions, fundraising, and capital structure to optimise an organisation’s financial performance and value.

- Forensic Accountant – A Forensic Accountant investigates financial discrepancies and frauds, using accounting skills to analyse financial evidence for legal cases and dispute resolutions.

- Compliance Officer – A Compliance Officer ensures that an organisation adheres to legal standards and internal policies, reducing risk and maintaining the company’s integrity in its operations.

- Financial Planner – A Financial Planner assists individuals in managing their finances by creating strategies for meeting long-term financial goals, including investments, savings, and retirement planning.

Career Growth Prospects

The growth prospects for an ACCA graduate are quite promising due to the globally recognised and respected nature of the qualification. Here are several key aspects that highlight the growth opportunities:

- Global Mobility: As ACCA is an internationally recognised qualification, it offers career mobility across different countries and industries, allowing for a diverse range of job opportunities.

- Wide Career Options: ACCA graduates can choose from a variety of career paths in finance, accounting, taxation, consulting, and corporate finance, among others.

- Professional Development: The ACCA qualification provides a strong foundation in accounting principles and practices, which can be continually built upon through additional certifications, specializations, and continuous professional development (CPD) requirements.

- Leadership Opportunities: With experience, ACCA professionals can ascend to senior management roles, such as Chief Financial Officer (CFO), finance director, or partner in an accounting firm.

- Evolving Expertise: The ACCA curriculum is designed to evolve with changes in the finance industry, ensuring that its members are up-to-date with current best practices and technologies, making them valuable assets to their employers.

- Networking: ACCA provides a vast network of professionals, which can be beneficial for career growth through mentorship, job opportunities, and professional collaboration.

- Demand in Various Sectors: ACCA professionals are in demand in all sectors, including public practice, industry, commerce, and the non-profit sector, which provides resilience in economic fluctuations.

- Entrepreneurial Opportunities: The comprehensive skill set and knowledge base of an ACCA graduate also offer the opportunity to start their own business in financial consultancy or accountancy.

Salary After ACCA

ACCA Salary on Basis of seniority

In India, ACCA certified professionals are well-regarded in the finance and accounting industry, with their compensation reflecting their expertise and designation within a company. Here’s an insight into their earning potential and career growth:

- Entry-Level (Fresher): Fresh ACCA affiliates typically earn between INR 4 to 5 lakhs per annum.

- Mid-Level (Member): Members of ACCA with a few years of experience can expect to earn between INR 7 to 10 lakhs annually.

- Senior-Level (Experienced Professional): Seasoned ACCA professionals, especially those in senior roles or with over a decade of experience, see their salaries range from INR 18 to 25 lakhs per annum.

National Average: The national average salary for an ACCA professional in India is around INR 8 lakhs per annum.

ACCA Average Salary For Different Job Roles

| Job | Average |

| Accountant | ₹3,50,000 |

| Finance Manager | ₹11,00,000 |

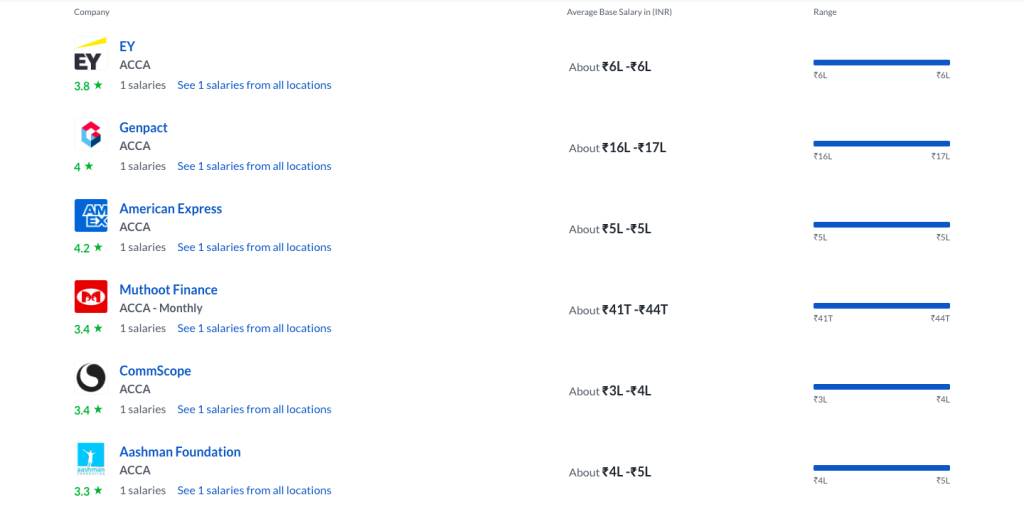

Salary Range For ACCA in Different Companies

In some cases, especially for those working with multinational companies and holding high-ranking positions, the earning potential can go up to INR 20 lakhs per annum or more.

Here is a infographic showing the average salary of an ACCA in different companies in India –

Source: Glassdoor

If you want to know more about ACCA Salaries and Job Opportunities, read – ACCA Salaries, Jobs and more.

Value for Money and ROI of Pursuing ACCA

The cost of pursuing ACCA in India could be around ₹ 2,50,000 minimum and could go higher depending largely on the number of attempts taken to clear the examinations.

The question of whether pursuing ACCA is ‘worth it’ largely depends on individual career goals and circumstances.

Initially, ACCA freshers can expect a salary ranging between ₹ 4 – 5 lakh. As they gain experience, the upper limit for the annual income could be anything. However, ACCA members are increasingly earning ₹25 lakhs per annum and beyond.

Bottom Line – With its international recognition, ACCA opens doors to global job opportunities, making it a solid investment for those eyeing an international accounting career.

To understand whether ACCA is worth it for you or not, read – Is ACCA Worth it?

Comparison of ACCA with Other Accounting Qualifications

ACCA Vs CA

| Feature | ACCA | CA |

|---|---|---|

| Global Recognition | Highly recognized internationally | Recognized mainly in the country of certification |

| Flexibility | Flexible exam schedules and study options | More structured with mandatory practical training |

| Exam Structure | Broad syllabus with global accounting standards | Focused on country-specific accounting standards |

| Career Opportunities | Diverse international opportunities | Strong in specific markets, especially in audit and tax |

| Specializations | Variety of roles in finance and accounting | Specialized roles in local financial practices |

| Salary Prospects (India) | ₹4 lakh to ₹7 lakh for freshers; up to ₹35 lakh for experienced | ₹9 lakh to ₹12 lakh average; exceeds ₹20 lakhs for experienced |

| Professional Development | Continuous learning with a global perspective | Emphasis on local financial regulations and practices |

To get a more in-depth comparison of the courses, read – ACCA vs CA

ACCA Vs CMA

| Criteria | ACCA | CMA |

|---|---|---|

| Eligibility Criteria | 10+2 with English and Mathematics/Accounts; Graduates get exemptions | 10+2 from a recognized board; Graduation required for exam |

| Requirements to Complete | 13 exams, 36 months of experience, Ethics module | 2 exam parts, 2 years professional experience |

| Difficulty | Broad range of topics; considered more challenging | Focused depth in management accounting; analytical rigor |

| Career Opportunities | Diverse roles in accounting, taxation, consultancy | Management accounting, strategic management, financial analysis |

| Costs | Approx ₹2,30,000 | Students: Approx ₹92,000; Professionals: Approx ₹1,30,000 |

| Time to Complete | 3-4 years on average, up to 10 years allowed | Typically 18 months to 2 years |

| Average Salary in India | Entry-level: ₹4-6 Lakhs; Senior-level: ₹10-20+ Lakhs | Entry-level: ₹5-7 Lakhs; Senior-level: ₹12-25 Lakhs |

| Future Prospects | High global demand, but needs to adapt to tech advancements | Strong in data-driven decision making, risk of over-specialization |

To get a more in-depth comparison of the courses, read – ACCA vs CMA

ACCA Vs CIMA

| Criteria | ACCA | CIMA |

|---|---|---|

| Eligibility Criteria | Post-10th with FIA or 12th; Graduates receive exemptions | Post-12th or Graduates; MBA/CA for accelerated entry |

| Completion Requirements | 13 Exams, Ethics Module, 36 months Practical Experience | Tiered Exams, 3 years Practical Experience |

| Time to Complete | Approximately 3-4 years, depending on exemptions and study pace | Approximately 3-4 years, varies with exemptions |

| Scope | Comprehensive in accounting, taxation, audit; broader scope | Focused on management accounting; strategic business orientation |

| Global Recognition | Highly recognized in over 180 countries; versatile across sectors | Strong recognition, especially in management roles |

| Average Salaries | Entry-level: INR 4-6 Lakhs; Mid-level: INR 6-15 Lakhs; Senior: INR 15+ Lakhs | Entry-level: INR 5-7 Lakhs; Mid-level: INR 10-20 Lakhs; Senior: INR 20+ Lakhs |

| Cost | Approximately INR 2,30,000, excluding study materials and additional resources | Ranges from INR 2,00,000 to 3,00,000, excluding additional costs |

| Future Prospects | Versatile career paths in finance and accounting; high demand in various sectors | Strong in roles requiring strategic financial management and business strategy |

To get a more in-depth comparison of the courses, read – ACCA vs CIMA

Tips and Study Materials for Passing ACCA Exams

Tips and Strategies for Passing ACCA Exams

- Understand the Syllabus: Having a thorough understanding of the syllabus is crucial. Know the examinable topics and the weighting of marks allocated to each section.

- Practise Past Papers: Practising past papers helps familiarise with the exam format and improve time management skills.

- Use Approved Study Materials: Utilise the study materials and resources provided by ACCA and other reputable sources.

- Maintain a Study Schedule: Stick to a realistic study schedule, ensuring you cover all topics and have time for revision.

- Stay Updated: Stay updated with any changes in the syllabus or exam format.

- Health and Wellness: This is very undermined by students, but you should maintain a balanced diet, regular exercise, and adequate sleep to keep your mind and body in good condition.

- Seek Guidance: Don’t hesitate to seek guidance from tutors or online forums whenever necessary.

- Join a Study Group: Engaging in discussions with peers can provide different perspectives and clarify doubts.

Resources and Study Materials for ACCA Preparation

- Coaching Centres: Enrol in coaching centres or join ACCA Online Classes for structured learning, access to experienced tutors, and exam-focused study materials.

- Official ACCA Resources: ACCA provides a range of resources including study guides, syllabus guides, and specimen exams which can be found on the official ACCA website.

- Online Forums and Communities: Participate in online forums and communities dedicated to ACCA exam preparation to share knowledge and experience. (like ACCA Forum for Students)

- Revision Kits: Utilise revision kits from reputable sources which often contain practice questions and mock exams.

- Textbooks and Study Guides: Purchase or borrow ACCA Study Material or textbooks and study guides that cover the ACCA syllabus comprehensively.

These tips and resources can significantly aid in preparing and passing the ACCA exams, contributing to a successful ACCA qualification journey.

Conclusion

Wrapping up, ACCA isn’t just a course, but a journey that shapes you into a financial maestro capable of steering organisations through turbulent economic waters. The comprehensive curriculum, spanning across a blend of theoretical knowledge and practical skills, prepares you for the diverse challenges you’ll face in the financial realm. The flexibility embedded in the course structure, exam scheduling, and the global recognition it holds, makes ACCA a coveted and sensible choice for anyone aspiring to soar in the finance domain.

Moreover, the rewarding career prospects, the global network you become part of, and the continuous learning and growth opportunities, make the investment in ACCA a worthy one.

Frequently Asked Questions on ACCA Exam

Yes, qualified professionals like CA, MBAs or Accounting Technicians, may receive exemptions from certain ACCA exams.

It is a module that focuses on developing a range of professional behaviour required in an accounting environment.

ACCA qualification can lead to various roles like Financial Accountant, Tax Advisor, Finance Manager etc.