Upskill Yourself

Certification in Risk Modeling

- Risk Modeling Course with 100% Placement Support

- 100 + Hours of HD Video Content with Detail notes

- Lectures by seasoned Finance Professionals and industry experts.

- Hands-on Risk Modeling simulations for practical application.

- Real-world case studies and examples from notable deals.

Get a Call - Back

Skills You Will Gain

Risk Frameworks

Basel & IFRS‑aligned models

Market Risk Tools

VaR, ES, Stress Tests

Credit Models

PD, LGD, EAD scorecards

Portfolio Analytics

Risk budgeting & RAROC

Model Validation

KS, AUC, MoC

ALM & Treasury Skills

Liquidity risk & rate simulations

What Makes Us The Best?

Below are a few key points that make us a preferred choice amongst students for Risk Modeling Course

Fully Practical Approach

Learn risk modeling from the real-world perspective, not books

Highly Credible Trainers

Our trainers are Investment Bankers themselves and have extensive experience in core finance.

Most Detailed Curriculum

Our curriculum is THE MOST detailed across the Risk Modeling training industry

100% Placement Assistance

After the course completion, students get access to our placement network of 100+ recruiters

Risk Modeling Course Curriculum

Our curriculum is the most detailed, concept driven and Industry relevant.

How do we cover the syllabus efficiently?

Time Value of Money & financial mathematics essentials

Basel I, II, III overview – RWA, capital ratios, buffers

Risk categories: Credit, Market, Operational, Liquidity

Excel for risk: dynamic referencing, data tables, solver

Core statistics & linear algebra for quant applications

Linear & Logistic Regression (credit scoring)

Model fit tests: AUC, Gini, KS, confusion matrix

Time-Series Models: ARIMA, GARCH for volatility & returns

Monte Carlo Simulations for stress & scenario testing

Bootstrapping techniques for sampling & resampling

Bond math: Duration, Convexity, DV01, Key Rate DV01

Yield curves: bootstrapping & forecasting

Short rate models: Vasicek, CIR, Hull-White explained

ALM use-cases: Rate shocks, repricing gap, liquidity buffers

Basics of Options, Futures, Forwards & Swaps

Binomial Trees & Black-Scholes Option Pricing

Delta-Gamma-Vega hedging strategies

Derivative risk metrics & scenario stress analysis

VaR Approaches: Parametric, Historical, Monte Carlo

Expected Shortfall (CVaR) and Tail Risk analysis

Risk decomposition: incremental, marginal, component VaR

Stress Testing & Backtesting methodologies

FRTB & CCAR integration with Excel dashboards

PD models using logistic regression & scoring

LGD estimation from recovery data; EAD estimation logic

Basel IRB framework vs. IFRS 9 Expected Credit Loss

Stage-wise provisioning & model overlays in Excel

Model validation: override benchmarking, conservatism

Credit portfolio risk models: CreditMetrics, KMV, Merton

Risk budgeting using VaR and capital attribution

Risk-adjusted performance: RAROC, EVA, Sharpe Ratio

Asset Allocation under capital constraints

Validation tools: KS, ROC, AUC, stability indices

Model calibration & challenger model comparison

Documentation: assumptions, limitations, performance summary

Governance framework: MoC, backtesting, audit trails

- Build a full credit risk or market risk model from scratch

- Model walkthrough presentation to mentors

- Peer and mentor feedback for refinement and audit-readiness

Real-World Valuation Case Studies of Leading Innovators

Gain unparalleled insights into the art of Risk Modeling with our meticulously crafted case studies.

Basel III Risk Weighting

Delving into OTTs subscriber growth, content investment, and competitive positioning.

Credit Suisse IFRS 9

Innovation-driven valuation and the impact of technology on market capitalization

Lehmann Brothers VaR Failure

Assessing revenue models, growth trajectories, and the role of AI in market disruption

BlackRock Risk Budgeting

Pricing models, and impact on the tele- communications sector’s valuation landscape

Exclusive Content Access

Unlock Premium Resources: Your Comprehensive Risk Modeling Toolkit

Risk Modeling Handbook

A comprehensive guide covering the A-Z of Risk Modeling, from fundamental concepts to advanced strategies.

40+ Excel Templates

Ready-to-use Excel templates for various risk modeling scenarios, designed by industry veterans for real-world applications.

Mobile App With Up-to-Date Resources

Our Mobile Application provides instant access to all our study materials, updated regularly to reflect the latest industry trends

QuintEdge Vs Others

Unlock unparalleled advantages with Quintedge

Where we go the extra mile in Risk Modeling unlike any other

Offering

Others

24/7 Peer and Tutor Forums for immediate query resolution

No-Code Learning — 100% Excel Based

40+ Plug-and-Play Risk & Valuation Templates

Real-World Risk Modeling Case Studies (Lehman, Credit Suisse, etc.)

Exclusive industry insights with current market trends

Continuous course updates, ensuring current content relevancy

Full Length Mock Interviews with ‘Near’ Job Level Difficulty

Access to global finance job boards & internship opportunities

VIP guest lectures from top-tier finance professionals

Dedicated Faculty for last-minute doubt solving before Interview

Discover The Seamless Learning Experience

Features of Our Risk Modeling Course Platform

- Personalized study plans tailored to individual strengths and weaknesses.

- Detailed dashboards to track, analyze, and improve your learning journey.

- Engaging modules with simulations, gamified elements, and interactive case studies.

- Real-time forums, projects, and live Q&A sessions with tutors and peers.

- Learn anytime, anywhere with our seamless mobile app and responsive design.

Know Your Timeline

How to become a Risk Analyst?

Charting Your Path to Risk Modeling: A Step-by-Step Journey with Quintedge

Faculty for Our Risk Modeling Course

We’re here to help you every step of the way, from preparation to ongoing support and motivation.

Yash Jain

CA, FRM

- CA & FRM Qualified

- Specialization in FRM, CQF, and Derivatives Modeling

- Trained 20,000 Students

- Ex - Bain & Co.

Sudhanshu Kanwar

CFA, FRM, MBA (IIM-A)

- CFA, FRM, MBA (IIM-A)

- Specialization in CQF, FRM, and CFA

- Trained 10,000 Students

- Ex - Goldman Sachs

Sandesh Banger

MBA (IIM K), Ex – AVP-RBL Bank

- MBA (IIM K)

- Specialization in Credit Risk, Risk Modeling, and Basel Frameworks

- Trained 5,000 Students

- Ex - AVP-RBL Bank

Prisha Lodha

FRM, Ex – Zerodha

- FRM

- Specialization in Risk Modeling, and Financial Analytics

- Trained 5,000 Students

- Ex - Zerodha

Monthly Masterclasses By Industry Experts

Makeing You Well Versed With Current Industry Trends

Placements & Career Assistance

Placement Assistance Program

Crack Jobs At Best Finance Roles

Learn with real work experience and get placed at Top Finance & Accounting based Job Roles.

- Experiential Masterclasses by Investment Bankers

- AI Based Resume Maker Tool Trained by Industry Experts

- Interview Preparation AI tool based on 10,000 Questions asked in Real Interviews

- Job Opportunities in Core Finance Roles

Career Counseling

Personalized career guidance in identifying work goals and potential job roles

End-To-End

Extensive Support , starting from Job search, to getting the offer letter from Company

Access Duration

Until Placement

Job Applications

Unlimited

Mock Interviews

Unlimited

AI Based Resume Drafting

3 Drafts

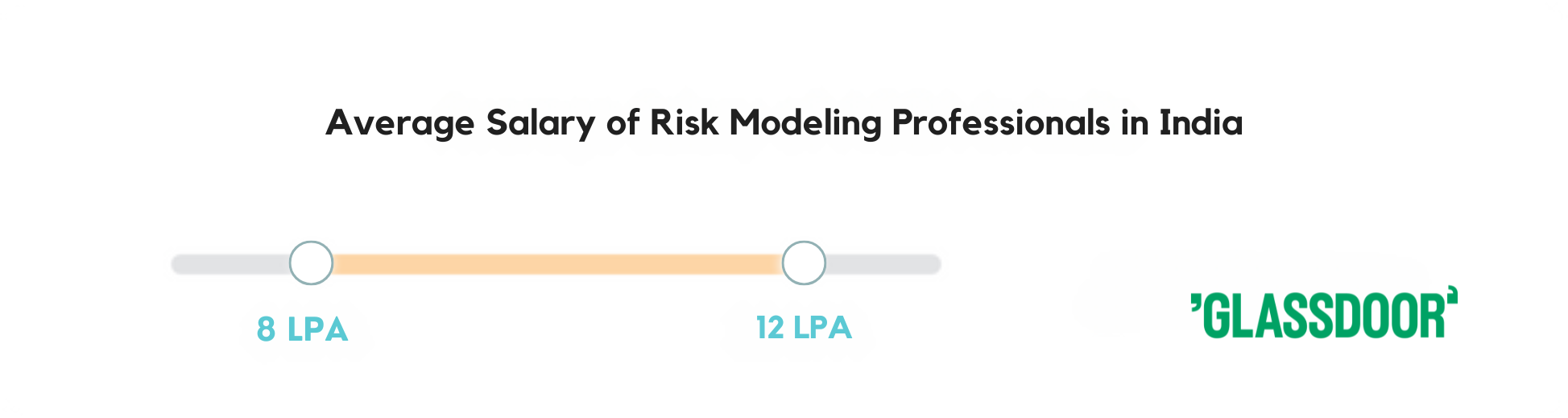

Risk Modeling Scope & Salary

Let’s get to know how this qualification can shape your future and career.

Growth & Recognition

Quant finance is a high-demand, future-proof career path driven by regulation, digital risk, and banking transformation.

Job Profiles

Get roles like Credit Risk Analyst, Risk Modeller, Market Risk Associate, Treasury Analyst & IFRS 9 Consultant.

Median Salary

Entry roles offer ₹7–₹12 LPA. With 3–5 years of experience, top profiles can reach ₹18–₹30 LPA.

Work At Big 4s, Investment Banks & MNCs

Build your Skillset with us and impress recruiters at Investment Banks, global MNCs, and Big 4s.

Your Future

Risk Modeling Salary & Career Opportunities

Professionals trained in risk modeling enjoy faster career growth, higher earning potential, and access to specialized roles in top financial institutions.

Credit Risk Analyst

₹6 – ₹10 LPA

Market Risk Analyst

₹8 – ₹12 LPA

Risk Modelling Associate

₹9 – ₹14 LPA

ALM Analyst

₹6 – ₹10 LPA

Treasury Risk Associate

₹7 – ₹12 LPA

Model Validation Specialist

₹9 – ₹15 LPA

Financial Analyst

₹6 – ₹10 LPA

IFRS 9 Consultant

₹10 – ₹16 LPA

Risk Consultant / Auditor

₹8 – ₹13 LPA

Financial Risk Consultant

₹9 – ₹14 LPA

Risk Reporting & MIS Analyst

₹6 – ₹10 LPA

Risk Modeling Course Testimonials

From the Past Candidates

Read on to know what our students have to say

Gursimar Singh

Mousam Bhawsar

Harrsh Bajaj

The learning which happened at Quintedge was very intuitive and logical which made it very easy to understand complex finance topics. Yash Jain Sir is a genius at his art and I would without any hesitation recommend him as one of the best teachers in the field of finance in the country.

Minal Gupta

I had an amazing experience with Quintedge, and I can confidently say that it played a huge role in enhancing my skills. The mentors and trainers were incredibly supportive and always made themselves available to clear doubts or offer career advice. The mock interviews and hands-on projects they provided helped me build confidence and gave me real-world experience

Vikas Burakoti

Yash sir is an Industry veteran, having tremendous exposure in the valuation field. His vast experience speaks when he teaches the concepts in the class with utmost detail and practical examples.

Fees & Variants of Risk Modeling Course

Certification in Risk Modeling

₹ 25,000

- 6 months of Live Training with Expert faculties and Hands on Practice

- Live Instructor Led Classes

- Access to Learning Portal with 180+ Hours of Video Content

- Real World case Studies

- Concept Wise Tests & Quizzes

- Discussion Forum Access

- Quintedge's In-house Risk Modeling Handbook

- Unlimited Doubt Solving

- Weekly Office Hours

Certification in Risk Modeling

₹ 20,000

- 100 hours of Self Paced Training with Expert faculties and Hands on Practice

- Live Instructor Led Classes

- Access to Learning Portal with 180+ Hours of Video Content

- Real World case Studies

- Concept Wise Tests & Quizzes

- Discussion Forum Access

- Quintedge's In-house Risk Modeling Handbook

- Unlimited Doubt Solving

- Weekly Office Hours

Placement Assistance Program

Extensive Placement Assistance for Certified Candidates

- Placement Support for core Finance Job Roles

- Monthly Industry Based Masterclasses

- AI Based Resume Maker & Interview Preparation Tool

Eligibility: Passing The Final Exam

Access Duration

6 Months

Note: Additional Success Fees of INR 35,000 ONLY after the student is placed

Integrated Risk Analyst Program

ADMISSION OPEN

- Especially For FRM Students

- Live Instructor Led Classes

- Access to Learning Portal with HD Video Content

- Training on Latest Finance Tools

- Placement Assistance

- Lectures With FM&V Industry Experts

- Risk Modeling Classes

Risk Modeling Course: Your Gateway to Modern Risk & Analytics

Risk Modeling has become one of the most in-demand and technically advanced career paths in today’s financial world. But what exactly is it, and why is mastering it essential for professionals in banking, consulting, and fintech?

With QuintEdge’s Risk Modeling course, you can gain practical, no-code expertise in building models used by global banks — from credit risk and derivatives pricing to portfolio analytics and IFRS 9 provisioning.

What is Risk Modeling?

Risk Modeling is the use of mathematical models, data analytics, and financial theory to make informed decisions in banking, risk, trading, and investment. From predicting portfolio volatility to estimating expected credit losses, quant finance helps firms manage risk and capital with precision.

At its core, it’s about turning financial complexity into logic — and logic into reliable models.

Why You Should Pursue a Risk Modeling Course in India

If you’re aiming for a high-impact, analytical, and future-proof finance role, here’s why this course is your best starting point:

Regulatory Relevance: Learn to build Basel- and IFRS-compliant models used by banks and NBFCs worldwide.

No-Code, Excel-Driven: Master VaR engines, PD/LGD scorecards, and derivative pricing — all inside Excel.

Career Versatility: Roles in risk modelling, treasury, ALM, validation, and consulting open up post-course.

High Demand, Low Competition: Unlike saturated IB/valuation roles, risk & modelling teams are actively hiring — but require trained professionals.

Global Alignment: Skills in VaR, Monte Carlo simulations, term structure models, and credit risk frameworks are transferable across markets.

Why Choose QuintEdge for Risk Modeling?

Choosing the right Risk Modeling course can be the difference between landing a high-paying risk analytics job and getting stuck in theoretical learning with little real-world application.

At QuintEdge, we offer India’s most practical, Excel-based Risk Modeling course — designed for students, finance professionals, and FRM/CFA aspirants looking to upskill in credit risk, market risk, and portfolio analytics.

Our curriculum is built around real-world regulatory frameworks like Basel III, IFRS 9, and FRTB, helping you build plug-and-play models that align with what banks and NBFCs actually use.

Here’s why thousands choose QuintEdge:

100% Excel-Based Learning — No coding required. You’ll build models from scratch using only Excel.

Globally Aligned Curriculum — Covers VaR, PD/LGD/EAD, Monte Carlo Simulation, CreditMetrics, and more.

Expert Faculty from Risk & Treasury Roles — Learn from industry professionals, not just trainers.

Placement-Oriented Training — Resume reviews, interview prep, and job support included.

40+ Excel Templates — Use real tools built for credit risk, portfolio VaR, ALM simulations, and IFRS provisioning.

Doubt Support & Community Access — Get real-time help through our active forums and weekly live sessions.

Frequently Asked Questions

Here are a few questions which our students ask every now and then. We have collated them all.

A Risk Modeling course equips you with advanced skills in risk modeling, portfolio analytics, credit risk, and statistical tools used in modern finance. You’ll learn practical applications of VaR, credit scoring, portfolio optimization, and financial regulations like Basel III—preparing you for data-driven roles in the financial sector.

You can target roles such as Risk Analyst, Credit Risk Modeller, Quantitative Analyst, Portfolio Manager, or Financial Data Analyst. The course opens up opportunities in banks, fintech firms, asset management companies, and consulting firms. Our team will support your career journey with industry insights and placement assistance.

This course is ideal for finance students, data-savvy professionals, and early-career analysts looking to specialize in risk and portfolio analytics. Even non-programmers can benefit, as the course focuses on Excel-based modelling and does not require prior coding experience.

Simply reach out to our counsellors through the website or contact number. They will walk you through the batch details, fee structure, and registration process.

Basic knowledge of accounting and statistics is recommended. However, we provide pre-course materials to help you quickly build a foundation before live sessions begin.

The live course includes 80 sessions of 3 hours each—totaling 240 hours of training. The recorded version provides approximately 150 hours of comprehensive learning.

While we don’t offer a job guarantee, we do provide ample placement opportunities and guidance for core quantitative roles. Your success will depend on your performance and effort during the program.

You’ll be eligible for roles like Credit Risk Analyst, Risk Modeller, Portfolio Analyst, Treasury Risk Associate, and other core roles in quantitative finance and analytics.

You must pass a qualifying test to earn the Risk Modeling Certification. There are unlimited retakes allowed to ensure all students meet the required competency.

Yes, students must clear the qualifying exam and obtain the certification to be eligible for placement support.

Still have questions?

If you can’t find answers to your questions in our FAQ section, you can always contact us. We will get back to you shortly.